5 ways to manage your money better for a more prosperous year of the Ox, 2021

The ongoing Covid-19 pandemic shows us just how fragile our life and our way

of living can be. Now more than ever, we need to be prudent in how we spend our

money. Below we share 5 ways how we can manage our money better for a more

prosperous 2021. Here’s to a “huat” year of the Ox!

1. Save first

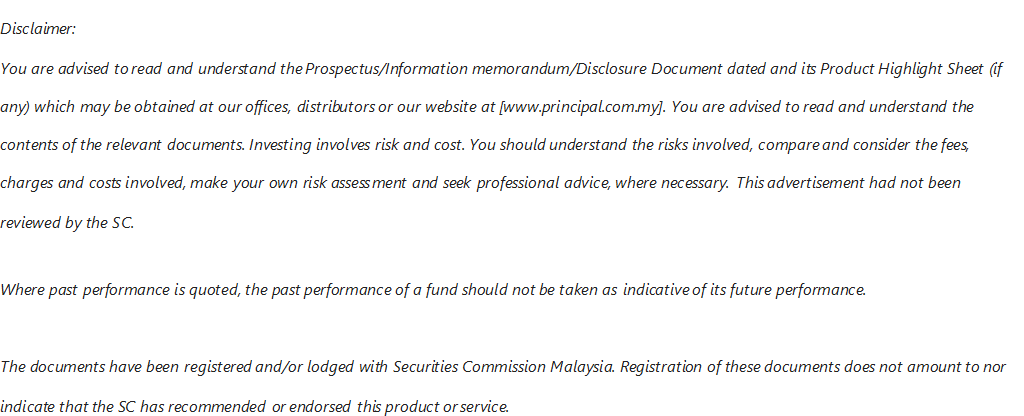

Aim to save 10-15% of your income before spending on anything. Think of saving as paying for your future now. Simply put, the more you save now, the more financially comfortable you will be in the future, especially when you take advantage of compounding interest to significantly grow your savings.

“Do not save what is left after spending; instead spend what is left

after saving.” ― Warren Buffett.

Experts recommend saving 20% of our net income (i.e. after tax) for the future. This includes adding money to an emergency fund, retirement savings. We should ideally have at least 3-6 months’ worth of our living expenses saved up in case of emergency, such as loss of job, medical problems, expensive home or car repairs etc. After you have set up the 3- to 6-month buffer, you can start directing the 10-20% of your income saved each month into investments.

The rich seem to get richer and the poor, poorer… and much of this has to do with compound interest. Compound interest could help your money grow faster because interest is calculated on the accumulated interest over time as well as on your original principal.

Compound interest can also work against you, like when you don’t pay off your credit card balance.

The sooner you invest your money, the more you’ll benefit from compound interest – it’s not only how much money you put in, but also how much time you let your money work for you. One of the simplest ways to benefit from compound interest is via unit trusts, and schemes such as Private Retirement Scheme (PRS) and EPF i-Invest.

Examples of how compound interest works:

2. Set specific money goals

Goals keep us focused and motivated. To be effective, our goals need to be specific. List down all your goals for the short term (6 months to 5 years), medium term (5-10 years), and long term (more than 10 years). Be specific in the target amounts and how you plan to reach them and stick to the plan. A good step-by-step guide on how to set up financial goals and budget can be found here.

Examples of specific goals:

- Both you and your spouse save at least 10% of your monthly income towards buying a more comfortable home for your family within the next 5 years

- Trade in your car for a spanking new SUV in the next 3 years. Set aside RM300 every month towards the down payment for it.

“Goals are pure fantasy unless you have a specific plan to achieve them.” — Stephen Covey, author of The 7 Habits of Highly Effective People.

3. Keep track on your monthly expenses

Most people are simply unaware of how much money they spend – not so much on large purchases, but on the small things; and boy do those little things add up! If you could reduce your spending by just RM10 a day by cutting down on small expenses, that’s RM3,650 savings a year. Think of the nice holiday you can buy yourself with that!

Diligently jotting down how much you spend on what items may feel onerous at first but once you see how much money it helps you save, you’ll wonder why you did not start earlier!

4. Decide your priorities; spend on what is necessary

“Too many people spend money they haven’t earned, to buy things they don’t want, to impress people that they don’t like.” – Will Rogers, American actor and humourist.

Sure, we could splurge and have pretty/branded things, but surely not at the expense of our financial freedom.

Instead of buying a new bag every month, you could consider accumulating what you would have spent every month to buy an awesome branded bag at the end of the year.

Your luxury items will feel even more special if you work them into your goals, as rewards for hitting specific financial goals, or pay for them only from money that rework for you e.g. dividends or profits from investments.

5. Use the right tools to invest

Invest wisely. Steer clear away from get-rich-quick schemes.

Stocks provide the highest potential returns, and tend to be the most volatile, of investments. For those who have no appetite to actively follow stock performances, unit trusts are a good alternative as they are managed by professional investment managers and invest in a range of securities.

And then there are special schemes designed to help us Malaysians potentially grow our retirement fund, namely the Private Retirement Scheme (PRS) and EPF i-Invest.

Voluntary retirement scheme - PRS

PRS is a voluntary long-term savings and investment scheme designed to help all Malaysians supplement their retirement savings under a well-structured and regulated environment. PRS fund managers, or PRS providers, are approved by the Securities Commission. There are eight PRS providers offering some 50 funds; among them is Principal Asset Management Bhd.

You can claim tax relief of up to RM3,000 for contributions into your PRS

account (until assessment year 2025). Consider making monthly contributions

instead of a lumpsum at the end of the year to gain even more from compound

interest.

Mandatory retirement scheme, through EPF i-Invest

The EPF i-Invest, launched in August 2019, allows you to diversify part of your Employees’ Provident Fund (EPF) savings in approved unit trust funds digitally. You will have greater control to diversify your investments based on your risk appetite – aggressive, moderate or conservative, local or abroad. Take advantage of the 0% sales charge till 30 April 2021 to maximise your investment capital. Find out more here.

Bonus for you this CNY

Keep an eye out on promotions that make your investment go further. Principal Asset Management is running a “Huat Ah!” promotion in conjunction with Chinese New Year – earn up to 0.88% angpau from your total net investment amount when you invest with Principal EPF i-Invest.

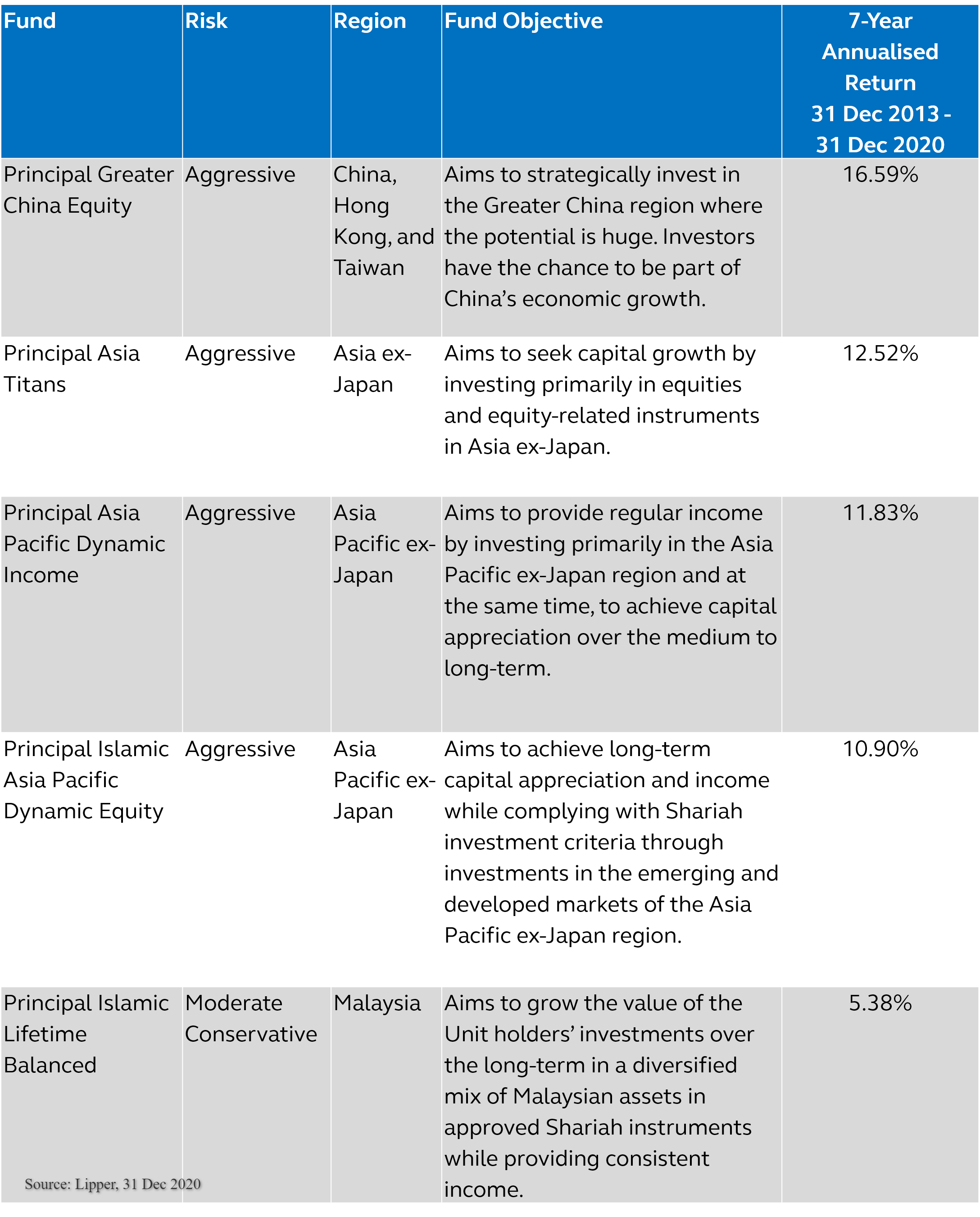

Below are the funds recommended by Principal investment experts:

Start investing, and earn a reward!

Click here for campaign information and terms and conditions.

RM12.50 / month

- Unlimited access to award-winning journalism

- Comment and share your opinions on all our articles

- Gift interesting stories to your friends

- Tax deductable