Covid-19 crippled economies, but the stock market remains in the pink of health

Covid-19 has crippled economic activities across the globe yet the stock market is doing well.

It’s still a bull market (i.e. prices are rising) and should stay so for quite a while yet, opined professional trader and investor Kathlyn Toh.

Everyone should invest in the stock market

“I highly encourage everyone to invest. Based on all the money printing in the world right now, the rich will grow richer because they are investing. The economies are doing badly but the stock markets are doing very well… Those who lose out are those who do not invest,” said Toh, who’s also the founder, director and chief trainer of Beyond Insights. However, before investing you need to make sure you get yourself educated on how to do it properly, so that you can manage the risk.

Beyond Insights, an award-winning investment and trading education outfit, hosts regular free webinars where you can learn about the four-step formula for consistent and accelerated returns in the global stock market.

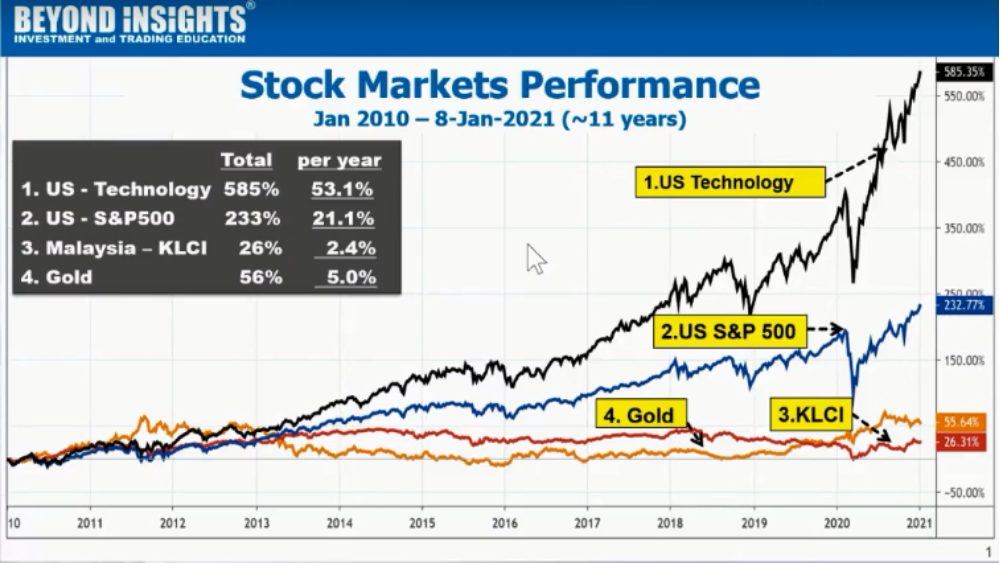

Toh advocates investing in the US stock market as the returns far exceeds that of the Kuala Lumpur stock exchange and there are many great quality global companies listed in the US stock market. Nevertheless, there are still some local companies worth investing with much longer term view, just that the overall economy growth is weak now and there are limited ones that can thrive in a prolonged Covid-19 environment and global competition. The chart below shows the performance of US Tech stocks and US S&P 500 stocks versus the KLCI, and gold.

“As an employee, you can only get a certain percentage of increment in salary a year. And given the impact from Covid-19, many are not getting any increment or bonus… some are not even getting paid. There is no way you can catch up to the rich. In the stock market, you can get about 20% return per annum by investing safely, even if you’re not an active trader. That is 10x more than what you can get from fixed deposits! That’s how we can reduce the wealth gap,” Toh said.

“I am confident the stock market can continue to go up, though there may be some volatility in the short term or some pullback, which is natural. My main confidence comes from money supply. There is so much of it in the world,” she said.

The US alone has pumped in trillions of dollars in stimulus packages to help prop up its economy battered by Covid-19. They include a US$2 trillion stimulus unveiled by the Federal Reserve, a US$2 trillion stimulus approved by the Trump administration, a US$900 billion rescue plan approved by Congress, as well as the Biden administration’s push for a US$1.9 trillion fiscal stimulus package.

“Where would all the money go? It has to go somewhere, into some asset class, and stock market is one of the primary targets... As long as the money is in the economy, then the confidence in the stock market will be there,” Toh said, adding that the prevailing low interest rates have also increased the attractiveness of investing in the stock market.

Toh presented Malaysiakini’s The A.B.C. Effect on Global Stock Market 2021 webinar recently where she spoke at length about the A.B.C., which in this instance stood for America, Biden and the Coronavirus.

The stock market is affected by consumer spending at the fundamental level. The USA is the largest consumer, accounting for one-third of global consumption. “We want the US economy to be doing well. Right now, it’s fine. The second-largest economy is Europe as a whole, which is not doing so well; that is our primary concern. The third largest is China. Good news, China is recovering,” she said.

She highlighted one important aspect of the stock market – it runs 6-9 months ahead of the economy. “We cannot look at what is happening right now to determine what we want to buy. The situation right now is pretty dire in terms of Covid-19 cases. We need to look 6-9 months ahead. By then, the global economy should be recovering due to the vaccine rollout.”

Which sectors should you invest in?

The safest bet is still technology. Despite the lockdowns, we still need technology, Toh said.

She said that for newbies, it would be safer to go for software companies, rather than semiconductor companies or green stocks unless one knows the industry well.

“Technology also changes very fast. You need to understand that when you invest in a company and it has competitors, they may threaten its long-term survival. That’s why for beginners, investing in ETFs would be easier than investing in individual companies,” she said.

ETF stands for Exchange Traded Fund. It’s just like a unit trust fund in Malaysia where the public can invest money in the fund that is managed by a fund manager. “Exchange traded” means it’s listed on the stock exchange so you can buy and sell these funds yourself without going through an agent, Toh explained.

Two ETFs she recommends for beginners are Invesco QQQ ETF which tracks the Nasdaq 100 Index and the SPDR S&P 500 (or SPY) which tracks the US S&P 500 stock market index. The performance of both are in the chart above. Those with more experience and want to invest in leading stocks in China, Hong Kong and Taiwan can do it through EEM (iShares MSCI Emerging Market ETF). Take note that timing is also important as most of these ETFs are high now.

When is the best time to buy stocks?

It all depends on your trading style, she said.

“For example, short-term intraday trading can get you 5-10% returns per month. That’s like 60% per year on the lower end, provided you can master the skill. You do need to commit the time and you need to practice and control your psychology well.”

But if you cannot commit the time to master the trading skill, I would encourage you to do some investing at least. With just 1 hour a month, you can still do passive-style investing, using ETF. You just need to know how to read the stock charts and fundamentals. If you have more time, then you can actually invest in direct stocks.”

Sign up for Beyond Insights’ upcoming webinar titled "Global Investing Made Simple" which you can join for free! Check out its social media Beyond Insights Investment & Trading Education or its website: http://beyondinsights.info/mk2021 to find out more.

RM12.50 / month

- Unlimited access to award-winning journalism

- Comment and share your opinions on all our articles

- Gift interesting stories to your friends

- Tax deductable