For FinTech – the ‘new normal’ in finance

The FinTech Landscape

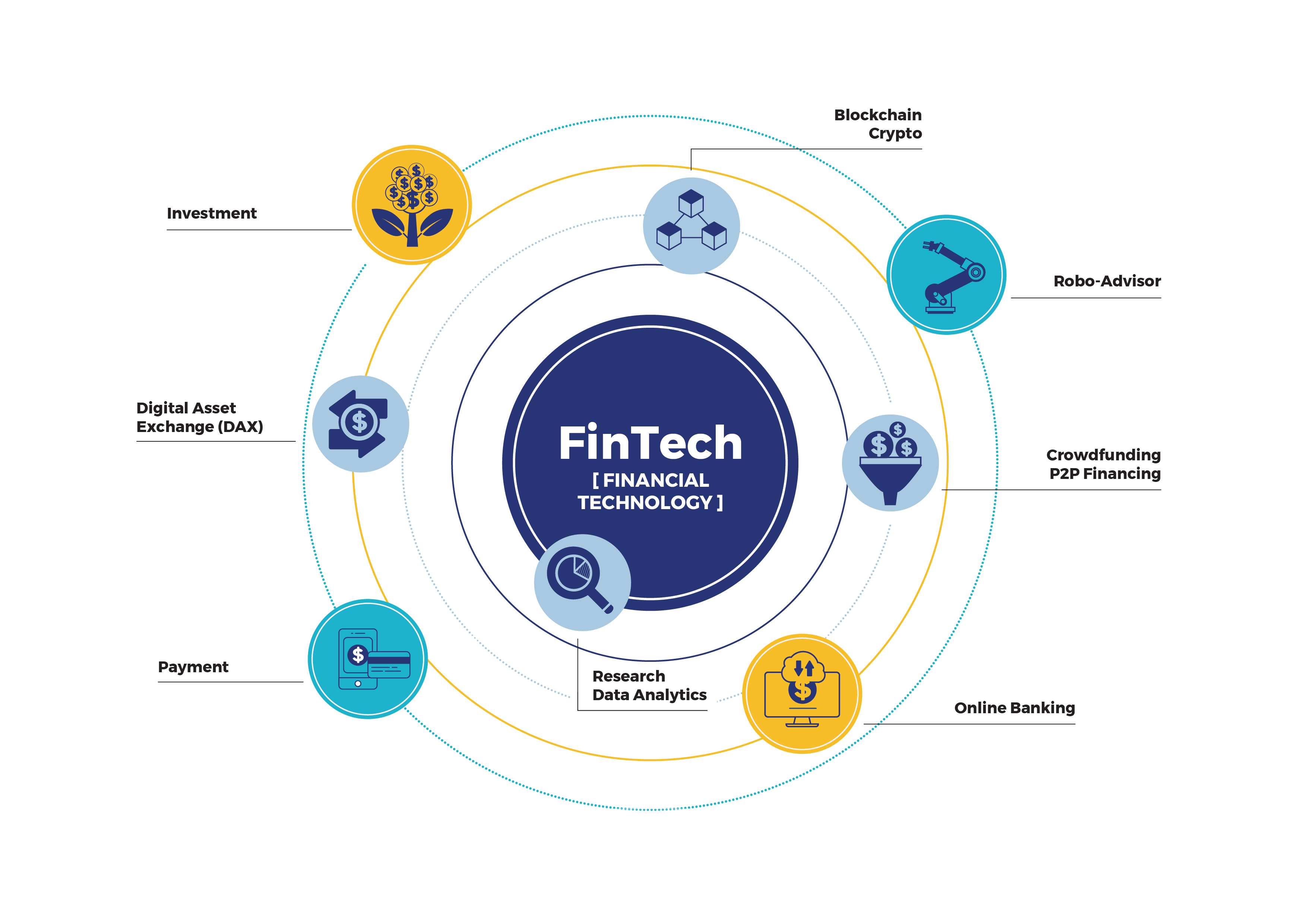

In the age of Industrial Revolution 4.0 (IR4.0), intelligent technologies are rapidly transforming almost every aspect of our life - these also include how we engage in our day to day monetary transactions, how we pay for our bills and how we invest in currencies and other financial assets. Cash is no longer the king, as physical banknotes are now being replaced by digital currencies, e-wallets and digital payments are the new forms of payment. These transformations are spurred by the application of Financial Technology (FinTech) which embodies IR4.0 technologies, such as Blockchain, Artificial Intelligence (AI) and Data Analytics.

FinTech has risen to challenges posed by Covid-19 by delivering digital, secure, seamless user experiences. The way people manage their finances has dramatically changed with the convenience of FinTech technologies. In 2020, online and mobile banking penetration reached 112.5% and 61.8% respectively, and RM 460 million worth of mobile banking transactions were conducted – a 125% jump compared to the previous year. ₁The Malaysian government’s Movement Control Order (MCO) acted as a catalyst, helping to add 3 million new mobile banking service subscribers last year as well as pushed e-wallet usage and adoption to new highs.

Technology Disruption & FinTech talents

Research conducted by the University of Oxford found that accountants have a 95% chance of being impacted by AI technologies. This phenomenon also signifies that accounting & finance professionals have to embrace rapid transformation and adapt to technological advancements. There is a need to be equipped with the strategic knowledge and technical skills for them to stay through new job roles such as FinTech specialists and business data analysts within the industry.

In the National Policy on Industry 4.0₂, FinTech has been listed as one of the areas that require talents, This need has been further fuelled by the Government’s plan to transform our digital economy. Apart from the government encouraging the masses to use e-wallets through the e-Tunai Rakyat under Budget 2020₃, Bank Negara Malaysia also announced its plans in 2018, to issue up to 5 licenses for the operations of digital banking within the country₄ to encourage industry players of the financial sector to put innovative technologies into use. Hence the need for talents in FinTech, who possess the essential financial fundamental knowledge as well as the ability to apply technological know-hows in traditional financial services has become even more critical.

The APU Advantage – Infusing IR4.0 into Programmes

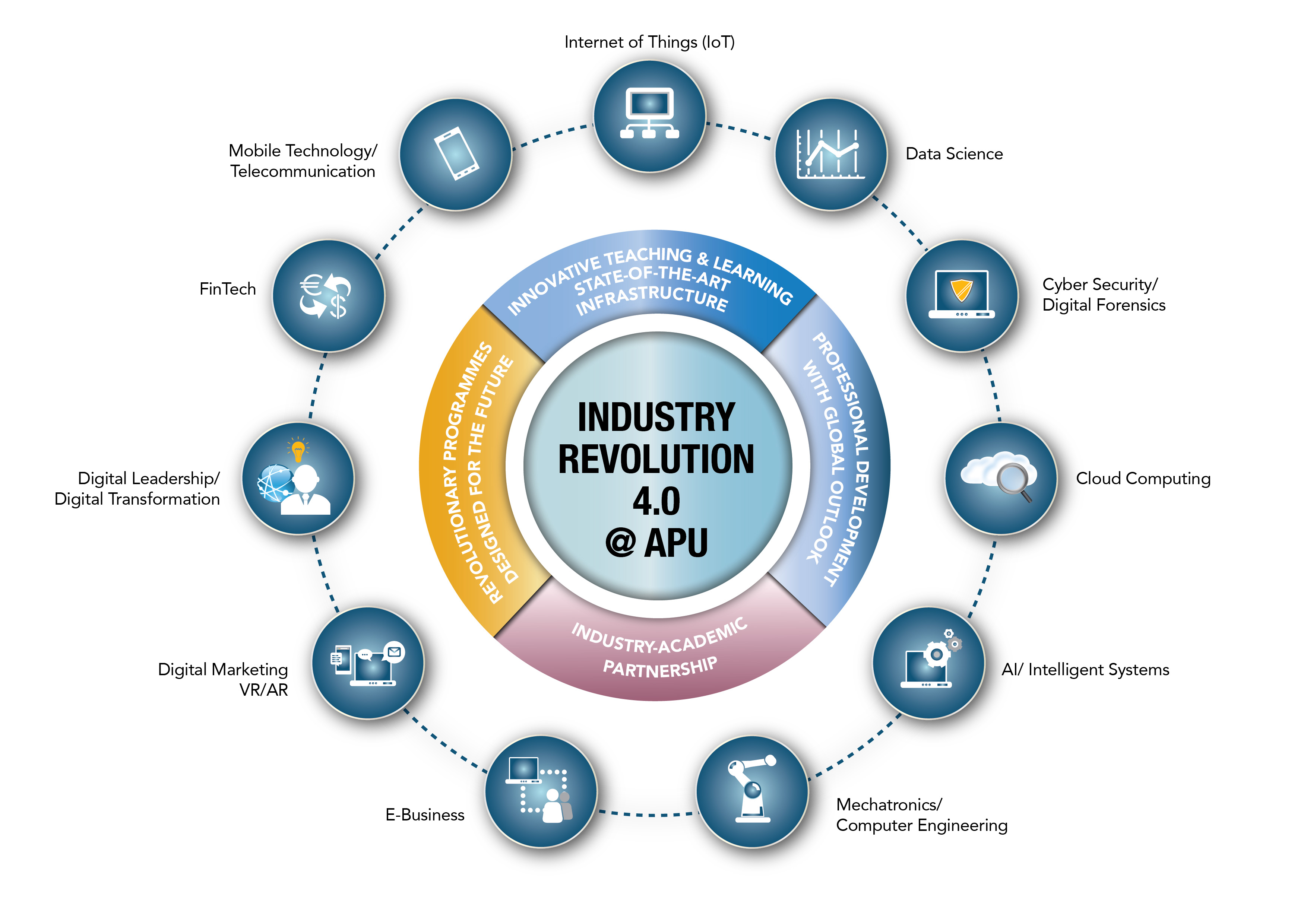

As one of Malaysia’s Highest Rated Premier Digital Tech Universities, established its own IR4.0 Strategy, Asia Pacific University of Technology & Innovation (APU) has formed an ecosystem that facilitates the delivery of IR4.0-relevant programmes infusing the following technologies:

As part of this ecosystem, FinTech education is integrated into the Accounting, Banking & Finance disciplines, powered by concepts & applications of blockchain technology, Robo advisory, FinTech governance & risk management, digital currencies & cryptocurrencies and crowdfunding. All students under APU’s Accounting, Banking & Finance programmes are exposed to the Essentials of FinTech through specially-designed FinTech modules, to ensure that they are not alienated by the rapid transformation happening around the financial sector when they graduate.

Pioneering FinTech programmes

For school leavers / future IT professionals, APU offers Malaysia’s first academic programme in FinTech₅ – the Bachelor of Banking of Finance (Hons) with a specialism in Financial Technology (FinTech)₆, in addition to the BSc (Hons) Information Technology with a specialism in FinTech₇ programme.

With the recent launch of the Master of Finance with a specialism in FinTech postgraduate programme, career professionals can now stay relevant and keep up with cutting edge disruptive technologies, which are prevalent within the financial sector.

APU’s FinTech education was established together with the industry. The first FinTech academic degree in Malaysia offered by APU was built in collaboration with SuperCharger, Asia’s leading FinTech Accelerator through an MOA inked in 2018. To leverage on local opportunities as well as to address the talent needs of Malaysian FinTech and Banktech institutions that are facing a talent shortage₈.

Career and Internship Opportunities in FinTech

APU also became the first and only university to sign a pact with the FinTech Association of Malaysia (FAOM) in March 2020. This new partnership opens a whole window of opportunities as APU’s FinTech students are now exposed to career and internship opportunities with over 80 members of FAOM, which include leading banks, financial institutions and Fintech platforms. Industry-focused FinTech activities are set to take place at APU in collaboration with the member companies of FAOM, providing students with relevant industry exposure even before they graduate from university. Industry experts from FAOM will also provide inputs in enhancing the programme to comprise key areas of FinTech, namely digital currencies, blockchain technologies, crowdfunding, Robo-advisory and entrepreneurial finance.

APU School of Accounting & Finance

APU’s School of Accounting and Finance is headed by Prof Dr Nafis Alam who himself is the only one from Malaysia and one of six from the Asia Pacific region to be featured in the top 100 social media influencers shaping the conversation in the FinTech₉. Prof Nafis who has recently published a book on FinTech and Islamic Finance₁₀ has extensive engagement with the industry and FinTech circle which will further boost the delivery of the programme.

For more information, visit www.apu.edu.my

RM12.50 / month

- Unlimited access to award-winning journalism

- Comment and share your opinions on all our articles

- Gift interesting stories to your friends

- Tax deductable