EPF navigates safely through pandemic-stricken 2020

Total dividend payout of RM47.64 billion

Equities remain main driver of returns while Fixed Income provided stability

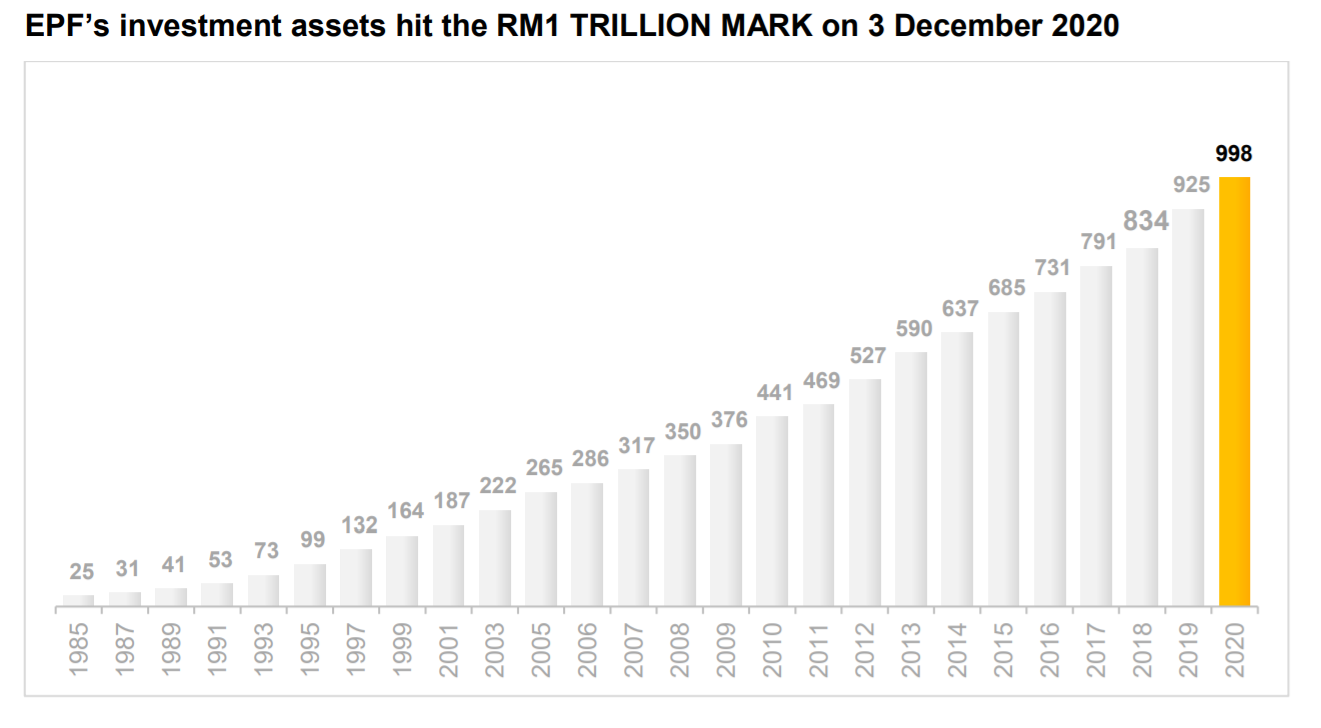

Investment assets hit RM1.02 trillion at end-2020

Despite the many challenges brought on by Covid-19, the Employees Provident Fund (EPF) delivered a solid performance in 2020, both in terms of operational as well as financial results.

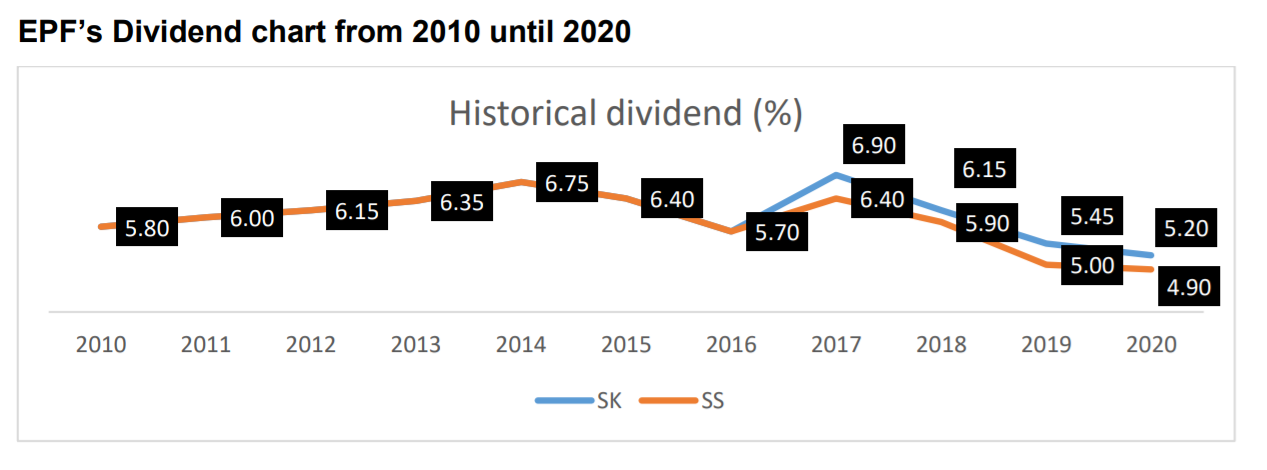

It declared dividend of 5.20% with a payout amounting to RM42.88 billion for Simpanan Konvensional, and 4.90% for Simpanan Shariah, with a payout amounting RM4.76 billion. Cumulatively, the total payout for 2020 amounts to RM47.64 billion.

With an average five-year real dividend of 4.62% for Simpanan Konvensional and 4.32% for Simpanan Shariah after adjusting for inflation, the EPF has exceeded its strategic target of declaring at least 2.00% real dividend on average for a rolling five-year basis.

EPF Chairman Tan Sri Ahmad Badri Mohd Zahir said, “We managed to safeguard our members’ retirement savings well, while meeting their immediate needs to deal with the current challenges. It was not easy at times as we had to walk a tightrope in ensuring that our members survive the difficult times while balancing their future needs.”

The EPF was proactive in managing the impact of Covid-19. The speed of adaptability in its investment strategy and processes ensured it was able to deliver optimum performance as it leveraged the strength of its approximately 250-strong investment professionals who diligently managed the portfolios and took proactive measures.

“Solid teamwork and digital infrastructure ensured that we could adapt seamlessly to the new work norms,” Ahmad Badri said.

The EPF also rebalanced its investment portfolios based on thorough consideration on how the Covid-19 pandemic and global uncertainties – such as the US Presidential election in November 2020, the continuous US-China trade dispute, and the impact of the Brexit negotiations – had influenced capital markets worldwide.

EPF’s investment portfolio in 2020

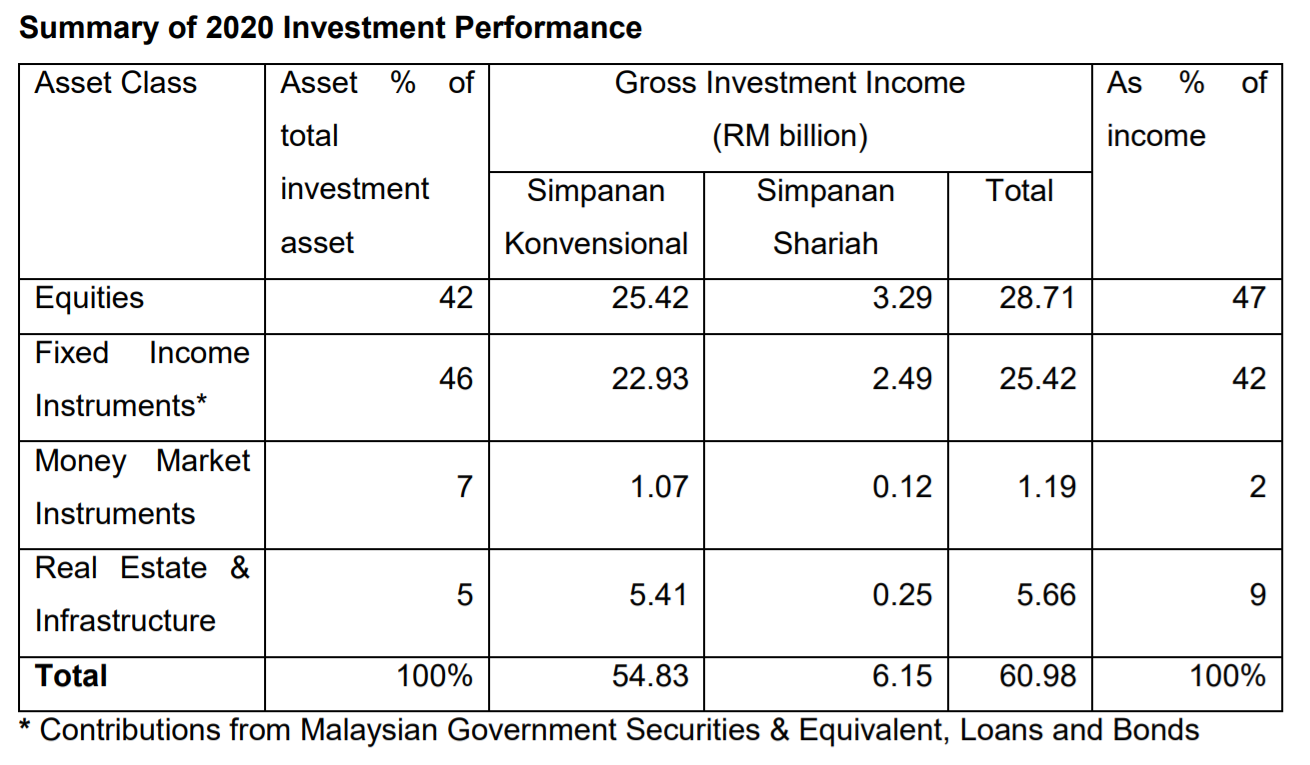

Following lower net contributions during the year, the EPF’s ability to adapt to the current times ensured its investments were able to deliver long-term sustainable returns under the new normal. The fund recorded its highest ever gross investment income of RM60.98 billion, with RM6.15 billion allocated to Simpanan Shariah.

The strong performance was due to the prudent approach guided by the Fund’s overall Strategic Asset Allocation (SAA), which has kept the EPF resilient despite the unanticipated crisis. By asset class, Fixed Income instruments made up 46% of investments, while Equities comprised 42%. Real Estate and Infrastructure as well as Money Market instruments made up 5% and 7%, respectively.

“The EPF is a long-term investor and remains steadfast with our diversification programme across asset classes, strategies, managers, markets, countries and currencies. The contribution from the overseas assets was also critical to our performance,” Tan Sri Ahmad Badri explained.

As at December 2020, 33% of the EPF’s investment assets were outside of Malaysia across all asset classes. Equities, particularly foreign equities, continued to be the driver of returns with a total income of RM28.71 billion.

As at end-December 2020:

- Total investment asset: RM998 billion (+7.9% vs. end-2009), with market value of RM1.02 trillion

- Fund membership: 14.89 million (+2%)

- No. of employers registered: 534,398

While leading stock indices lost as much as 40% in the first quarter, the EPF took the opportunity to rebalance its portfolio by acquiring shares that were fundamentally strong at attractive prices. The recovery in the second half of the year on the back of improved global and domestic markets contributed significantly to the EPF’s investment portfolios, providing for profit-taking opportunities, particularly in the fourth quarter.

The EPF also took prudent measures to write down RM7.71 billion of its listed equity portfolio, to ensure that the Fund’s long-term investment portfolios remain healthy.

EPF’s responses to the difficult times in 2020

The EPF responded to the challenging situation in 2020 by implementing several measures to help members and employers cope with cash flow issues following the Movement Control Order (MCO) from 18 March to 12 May when most economic sectors were closed.

i-Lestari Account 2 Withdrawal Scheme to provide members with some measure of financial relief. To date, a total of RM18.1 billion has been withdrawn by 5.16 million members under the i-Lestari facility.

Allowing members to lower their mandatory statutory contribution to EPF savings to 7% from 11%, effective April-December 2020.

Employer Covid-19 Assistance Programme (e-CAP), specifically targeted at small-and-medium enterprises (SMEs). e-CAP allows eligible SMEs flexibility to choose to apply for a deferment and restructuring of the employer’s share of EPF contributions, which benefited 13,090 employers with a cumulative value of RM84.95 million.

Janji Temu Online (JTO) introduced to ensured that social distancing measures and SOPs were strictly observed while the volume of visitors were reduced at physical branches.

Outlook for 2021

“The EPF, being a 70-year-old institution and one of the oldest pension funds in the world, will remain focused on our mandate to help members have enough savings for a sustainable retirement,” said Ahmad Badri.

He said that as the Fund works towards safeguarding and growing its members’ retirement savings in a volatile and uncertain environment, its emphasis on Environment, Social, and Governance (ESG) investing will continue to serve as an anchor and an effective risk mitigation tool, as well as be a value driver for its investments that will create social impact that could last beyond financial returns.

“We will also embark on a new withdrawal scheme to allow members to purchase insurance or Takaful products that was announced in Budget 2021, slated for an end of year rollout,” he added.

Reference Source: EPF

RM12.50 / month

- Unlimited access to award-winning journalism

- Comment and share your opinions on all our articles

- Gift interesting stories to your friends

- Tax deductable