Allianz Global Insurance Report 2021: Bruised but not broken

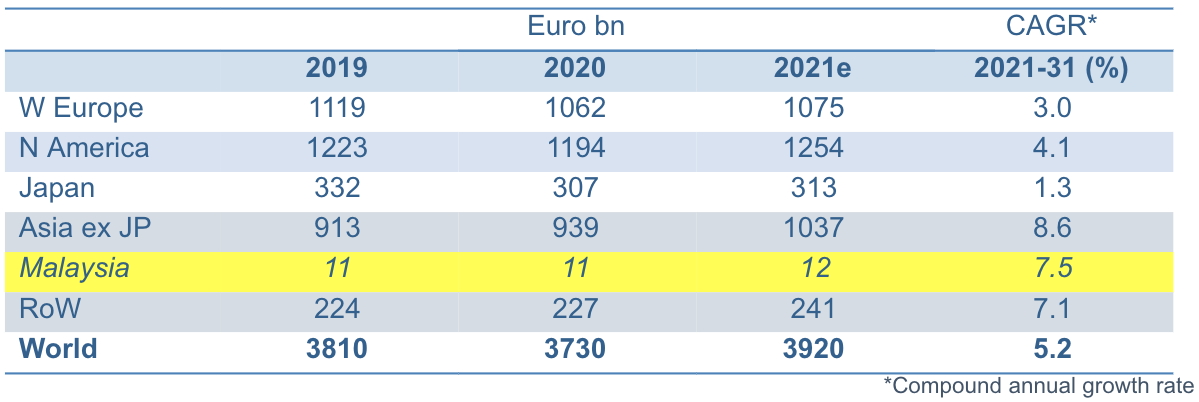

Today Allianz published its latest "Global Insurance Report", which analyzes the development of insurance markets worldwide. According to the report, the insurance industry got off relatively lightly during the Corona crisis: in 2020, global premium income fell by only 2.1%. Property insurance even recorded a small increase of 1.1%, while life business slumped by 4.1%. Overall, however, this decline was significantly steeper than in 2009 (-1.1%) in the aftermath of the financial crisis. Total premium income was thus around EUR 80bn lower than before the crisis, adding up to EUR 3,730bn (life: EUR 2,267bn and p&c: EUR 1,463bn).

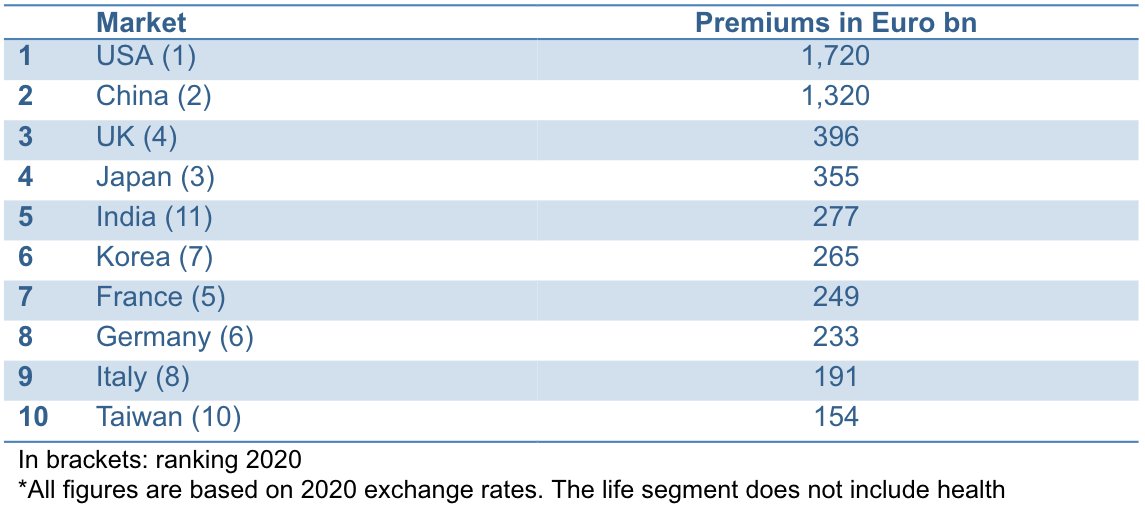

Strong growth is expected for the insurance industry in 2021. Overall, premiums should rise by 5.1% globally. Unsurprisingly, the USA (+5.3%) and China (+13.4%) are likely to be the two growth engines. Following the sharp slump in the previous year, the recovery in the life segment (+5.7%) will be somewhat stronger than in the p&c segment (+4.2%). The strong growth should continue in subsequent years, driven by the increased focus on sustainability and the further rise of the emerging markets. Globally, average growth of over 5% over the next ten years appears possible.

"The insurance industry proved resilient during the Corona crisis," said Ludovic Subran, chief economist at Allianz. "However, this was the relatively easier part of the exercise. Because the crisis has massively increased the demands of our stakeholders. This affects not least our clients, who, fully digitized, are having new expectations on customer engagement. For the industry, this means a profound transformation, away from a pure product logic and toward a holistic service approach that focuses not on financial compensation but on the management and prevention of risks. This is the only way the industry can adequately benefit from the increased need for risk protection in the post-Corona world."

Asia (ex Japan) weathered the crisis rather well and recorded an increase in premiums of 2.9% in 2020. Both lines grew more or less in sync, with p&c up by 3.1% and life by 2.9%. Total premium income reached EUR 939bn, of which 70% is earned in the life business. Recovery is expected to be much faster than in the rest of the world, reflecting the strong economic recovery: growth of 10.4% is expected in 2021 (life: 10.7%, p&c 9.7%). Average growth over the next ten years is expected to settle at 8.6% (life: 8.9%, non-life: 7.9%), only slightly below the level of the last decade (9.0%).

"Asia is setting the pace for the global insurance industry. That is all the more true in the post Covid-19 world," said Michaela Grimm, Allianz co-author of the report. "The numbers are simply breathtaking. Over the next decade, the region will contribute 50% of global premium growth; China alone will be responsible for 31%. But the Asian story is not only about growth. The Asian insurance market has become a springboard for new technologies and business models. In terms of platformization and customer experience it is years ahead of its Western counterparts."

In 2020, the Malaysian insurance market advanced by 4.9%. This strong development is entirely attributable to the life business, which accounts for 70% of premium income – and increased by a whopping 7.6%, more or less in line with pre-crisis growth levels. Premium in the p&c segment, on the other hand, declined by 1.0% (and was weak even before Covid-19 hit the economy). A strong recovery of 8.8% is expected in 2021, mainly driven by the life segment (+11.0%) while p&c returns to a more modest growth of 3.6%. Over the next decade, too, Malaysia is expected to achieve brisk growth of 7.5% per year, with the growth gap between life (+8.0%) and p&c (+6.1%) about to narrow. Premiums per capita will rise to almost EUR 700 at the end of the 2020’s, well above the regional average of EUR 600.

Insurance premiums in property-casualty and life*

The then biggest insurance markets by premium income (life and p&c) in 2031*

The interactive “Allianz Global Insurance Map” can be found on our homepage: https://www.allianz.com/en/economic_research/research_data/global-insurance-map/

You can find the study here on our homepage.

This content is provided by Allianz Malaysia Berhad.

Interested in having your announcements on Malaysiakini? Contact the announcements team at [email protected] or whatsapp on +60 17-323 0707 for urgent matters.

RM12.50 / month

- Unlimited access to award-winning journalism

- Comment and share your opinions on all our articles

- Gift interesting stories to your friends

- Tax deductable