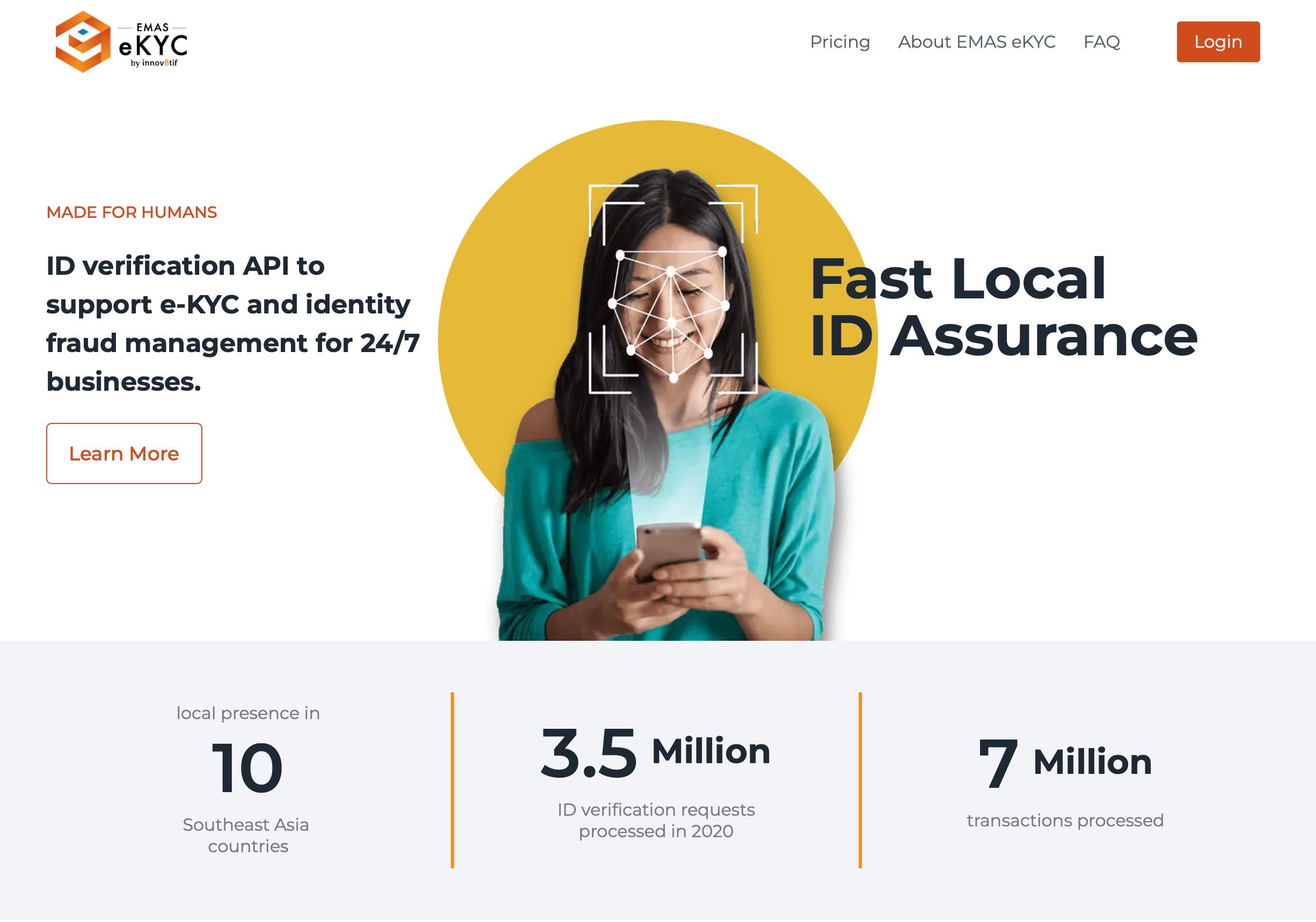

Launch announcement: EMAS eKYC API OnDemand

Innov8tif is proud to announce the launch of EMAS eKYC API OnDemand — an online service that empowers small-medium enterprises (SMEs) with the ability to incorporate client identity verification services into their mobile platforms or digital products.

EMAS eKYC API OnDemand does so by offering businesses easy access to the same API calls used by major banking and telecommunication institutions to qualify customers, prevent fraudulent user sign-ups, and fend off abuses in the account opening process.

"Innov8tif's mission statement is to make high-quality ID Assurance solutions accessible to everyone," says CEO George Lee.

"Traditionally, banks and telecommunication providers are the biggest beneficiaries of electronic know-your-customer (eKYC) solutions. This is because it greatly streamlines the customer onboarding process and its related bureaucratic operations. However, SMEs are now demanding similar services as well, due to the rising number of fake accounts, bot sign-ups and fraud attempts.”

Rising Fraudulent & Bot Account Signups

Fake account registrations now make up over one-third of bot-driven attacks detected in 2021, according to Arkose Labs, representing an over 70% increase from the end of 2020. Fraudsters are also leveraging automated tools to mass register fake accounts to improve the bots’ credibility scores, as stated in a report by NuData Security. This allows the bots to bypass many rules-based security protocols, currently making up 9.9% of attacks this year compared to 1.9% in 2020 — a five times increase within two years.

To combat this rising trend, businesses can incorporate eKYC solutions within the account sign-up process to serve as an additional layer of user identity verification. The user only needs to submit a live captured selfie photo and identity documents to qualify for the account registration.

However, incorporating eKYC via traditional methods can be difficult for digital startups and SMEs. In most cases, the business needs to exceed a certain number of monthly onboarding traffic to justify the time and costs involved in incorporating eKYC features in the first place.

EMAS eKYC API OnDemand attempts to resolve this problem by enabling businesses to purchase EMAS eKYC API calls directly without going through the traditional channels of engaging with Innov8tif personnel. This platform is suitable for digital startups and SMEs who do not process over 10,000 account openings on an annual basis, and are looking for a cheaper and quicker way to verify users.

How does it work?

According to standard eKYC guidelines, verifying users involves three major authentication factors — namely what the user possesses (e.g. identity card, passports), what the user knows (e.g. PIN code, security questions), and who the user is (e.g. Facial recognition, biometric authentication).

To achieve this, businesses can tap into Innov8tif's flagship product — EMAS eKYC, which consists of a growing number of API components that can be boiled down into four key functionalities:

Identity-Proofing Data Collection

The API accepts user submitted data, such as a selfie photo or a live identity document, and ensures that it is captured properly. Examples include ensuring that the images are properly lit, sufficiently large and are properly orientated.

Authentication

Using AI and ML algorithms, the data then undergoes a series of checks to ensure that it has not been tampered with or spoofed. Currently, EMAS eKYC can prevent common fraudulent attempts, such as using photoshopped images, photostat copies of documents, or spoofing attempts that use recorded photos and videos, or even deepfakes, as opposed to live facial image capture.

Extraction

Optical character recognition (OCR) technology is then used to extract the relevant information from the identity documents. Beyond just verification use, the collected data can be used to generate reports, or conduct further analysis, such as customer segmentation etc.

Comparison

Algorithms are used to compare the facial features extracted from the captured selfie to the existing portrait photo printed on the identity document, to determine if both are the same person.

Personal details extracted from OCR can also be compared to existing databases to estimate the user's onboarding risk. For instance, a bank can be alerted when a loan applicant has had a

history of bankruptcy, has criminal records attached, or has close political ties — all of which will influence the bank’s decision-making process.

Why Innov8tif?

EMAS eKYC is currently used by major institutions within the ASEAN region, from banking players to telecommunication providers. EMAS eKYC API OnDemand democratises access to these same ID Assurance tools by lowering its barrier of entry to regular businesses.

Not only does EMAS eKYC contain all the key components needed for eKYC to be conducted, each component undergoes constant upgrades via our rapidly growing product development team. This is because eKYC is a constant race against fraudsters, who are always poking and prodding for loopholes and weaknesses within the ID Assurance systems.

Founded in 2011, Innov8tif has also been serving businesses for more than a decade, with vast experience working with various project scopes and deployment methods. Hence, Innov8tif is well versed in the nuanced requirements and pain points commonly encountered within the industry.

Sign up for a free account today at the EMAS eKYC API OnDemand portal!

Interested to learn more about ID Assurance? Feel free to reach out to our dedicated team at [email protected] for more information.

This content is provided by Innov8tif Solutions Sdn Bhd.

Interested in having your announcements on Malaysiakini? Contact the announcements team at [email protected] or whatsapp on +60 17-323 0707 for urgent matters.

RM12.50 / month

- Unlimited access to award-winning journalism

- Comment and share your opinions on all our articles

- Gift interesting stories to your friends

- Tax deductable