How Boost Enables Digital Transformation Through Simplified Merchant Solutions

Micro, small, and medium enterprises (MSMEs) are inevitably the backbone of our economy and contribute significantly to our nation and region. Within ASEAN itself, MSMEs contribute to 85% of employment opportunities, 44.8% to GDP, and 18% to national exports¹. Closer to home, MSMEs make up close to 80% of all business establishments in Malaysia².

In order to protect this vital facet of the economy and ensure long-term growth within the industry, MSMEs need to adopt and implement digital solutions to give them a competitive edge, boost productivity, and increase their bottom line.

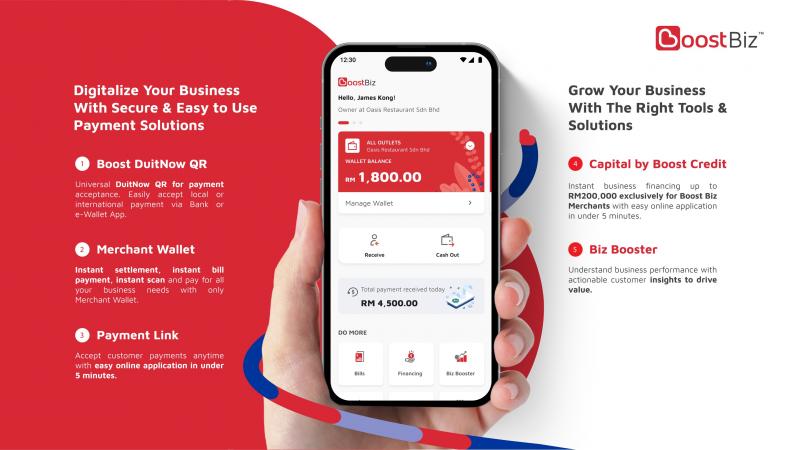

Business longevity is a goal that every owner wants to achieve, thus, MSMEs must be proactive in their efforts to find solutions to help them thrive. Fortunately for them, the Boost app offers easy to use curated business solutions that enables businesses to simplify their processes and make the digital transition seamless.

As the business landscape evolves, to remain relevant in the digital economy, small businesses emphasise the need for support and capacity building as they transition to a more sustainable and digitised business. In fulfilling this transition, MSMEs require better access to financing options, and reduced regulatory burdens with improved market access.

Through its micro-financing solution called ‘Capital’, which is powered by Boost Credit, its AI-based lending business targeted for MSMEs, Boost provides businesses with much needed support by providing alternative finance options. With short repayment periods of 12 months at a low profit rate of 1.5% per month, that require little or no collateral. By simplifying the lending process, Boost is ensuring that businesses can invest in their dreams without financial worry.

Additionally, going digital is no longer a differentiator, but a necessity to survive in the digital economy. With digitalisation, MSMEs can streamline their business processes for increased efficiency and enhance their productivity by automating their processes which helps them adequately manage their resources, time, and effort needed to complete a task. By becoming a Boost merchant, MSMEs can focus on building their business while Boost can help settle all their transactions by the end of each business day, making every working moment a seamless, rewarding experience for them and their customers.

When a business goes digital, data is then collected at a faster and more accurate rate. This data is converted into valuable insights and information that drive business decisions with enhanced agility to swiftly respond to a market change or opportunity. In fact, 86% of companies say they need access to real-time enterprise data to make smart business decisions³. This is reflected in Boost Biz Booster, a self-service analytics tool, which allows businesses to make informed decisions based on data gathered from sales, customers, and location, enabling small businesses to monitor business performance with smart notifications, and benchmark it to drive better decision making.

Apart from that, digitising a business has proven to reduce transaction costs by up to 90% as processes and tasks are automated⁴. When tasks and business processes are done manually, it is intrinsically slower than automated processes and often has a higher number of errors — resulting in hindered productivity and squandered resources. It’s safe to say that digitalisation not only reduces operational costs, but also boosts productivity.

Another newly added perk of becoming a Boost merchant is the Merchant B2B Wallet, that was launched early of the year. A revolutionary offering in the market that provides business owners with a wallet limit of up to RM500,000 that is integrated into the existing Boost Biz app with a QR code payment functionality that will enable merchants to further digitalise their businesses along with simplified transactions.

Aside from the larger wallet limit, merchants will enjoy a new ‘Instant Settlement and Payment’ feature that allows immediate access to cash upon receipt, eliminating the wait time settlement, which is typically cleared on the next working day. Merchants can also now instantly pay their business expenses such as utility bills and supplier invoices within the Boost Biz app itself upon receiving their customer’s payments.

Cash withdrawal is also a seamless experience as merchants are entitled to opt for the withdrawal request into their current bank accounts where it will be reflected on the next business day.

Leveraging new technologies and adopting digitalisation is a guaranteed way to future-proof MSMEs. By using the convenient, industry-leading solutions offered by Boost, merchants can ensure their business are in good hands, knowing that Boost is with them every step of the way to pave the way for all their business needs so they can be unstoppable.

References:

¹ Development of Micro, Small and Medium Enterprises in ASEAN (MSME)

² MSMEs must digitalise to survive, says MDEC

³ Over 80 Percent of Companies Rely on Stale Data for Decision-Making

⁴ Accelerating the digitization of business processes

This content is provided by BOOST Malaysia

RM12.50 / month

- Unlimited access to award-winning journalism

- Comment and share your opinions on all our articles

- Gift interesting stories to your friends

- Tax deductable