LETTER | Asean summit - An opportunity to reform taxes

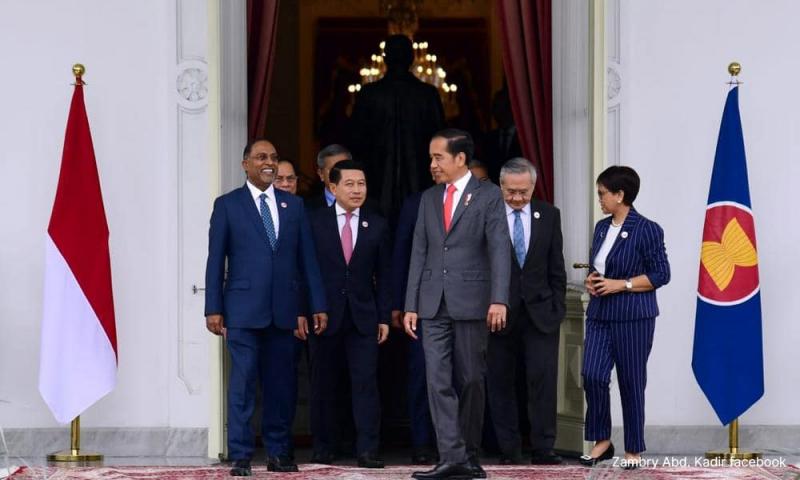

LETTER | It’s imperative that Malaysia holds serious consultations during the 43rd Asean Summit with Thailand, Indonesia, the Philippines and Vietnam to stop the race to the bottom in corporate tax rates.

The government must reform the economic and taxation system, which is currently too one-sided and lax towards foreign investors and multinational corporations (MNCs).

Malaysia's primary Foreign Direct Investment (FDI) competitors are Thailand, Indonesia, the Philippines and Vietnam.

They also face budget deficit problems like Malaysia, and need funds to implement programs to strengthen their social safety nets.

They also need funds to switch to electricity generation using solar, hydro and wind power, as well as strengthening public transport to reduce petrol consumption by private cars.

If one of these countries increases its corporate tax rate privately, there is a possibility that it will lose its FDI to other Asean countries to avoid paying higher taxes.

But suppose all these four countries and Malaysia increase their respective corporate taxes at the same rate. In that case, they will not face the problem of losing FDI to their Asean neighbours, as all these countries will collectively impose higher tax rates.

As a result of these higher taxes, all these countries, including Malaysia, will be able to acquire more funds, thus making it a win-win situation.

These funds can then significantly improve and strengthen the people’s socioeconomic status.

For a while now, the socioeconomic status of most Malaysians has been dire, thus resulting in high socioeconomic insecurity, especially among the B40 and the lower half of M40.

Thanks to the constant propaganda and fear-mongering by certain individuals and groups, this has created deep racial and religious insecurities that weigh heavily on a large segment of Malaysians.

With the acquisition of financial resources from the above measure, our government will be able to spend it on truly impactful pro-people programs that can significantly improve the socioeconomic status of ordinary people.

Examples of such programs are:

i) Increasing the minimum wage to a more appropriate and fair level.

ii) The establishment of trust funds using government funds to provide basic needs and services to the B40 and lower half of the M40 groups. These include low-cost housing, education, medical treatment and services, etc.

iii) Providing much more support in finance, infrastructure, skills training and access to large markets to the country's micro and small enterprises.

iv) Implementing a monthly RM500 pension scheme to all retirees aged 65 years and above from the B40 and M40 categories who are not covered by any other pension scheme.

v) Taking over the management and maintenance of low-cost flats by local councils throughout the country.

vi) Strengthening programs for developing, maintaining and upgrading public facilities as well as housing for rural residents.

It’s high time the government stops trying hard to please these MNCs and for them to be more responsible by paying their due level of taxes according to their actual wealth status.

The government's mission to eradicate corruption to stop fund wastage is important and just.

However, our broken and one-sided economic and taxation system is a huge problem and a weakness that must be dealt with immediately for the government to acquire much-needed funds to implement truly impactful programs such as the above.

Such programs will help eradicate people’s insecurities and create a more thriving and prosperous society.

The views expressed here are those of the author/contributor and do not necessarily represent the views of Malaysiakini.

RM12.50 / month

- Unlimited access to award-winning journalism

- Comment and share your opinions on all our articles

- Gift interesting stories to your friends

- Tax deductable