GST refunds were misused, full stop

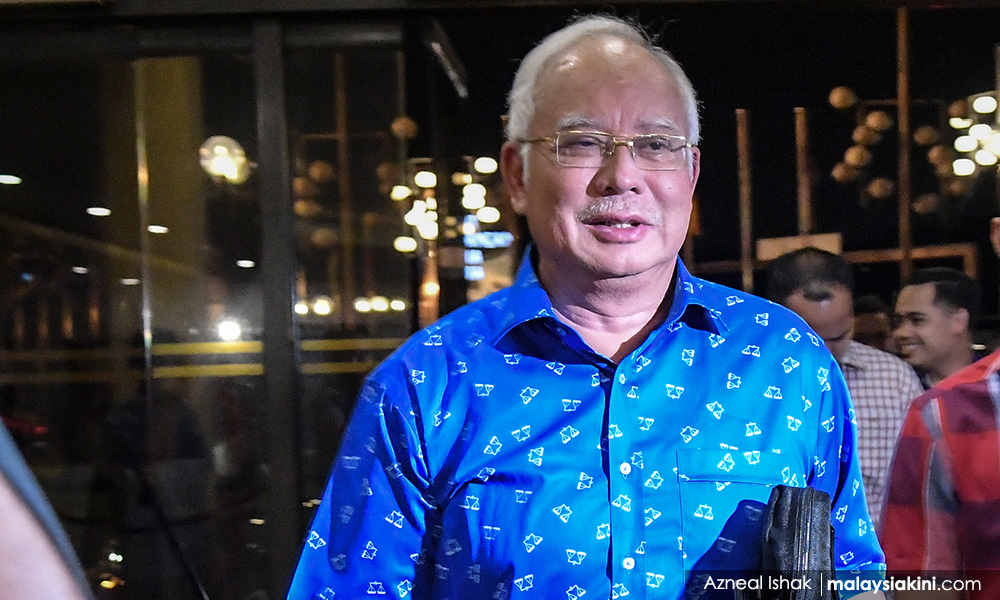

MP SPEAKS | The Public Accounts Committee’s (PAC) report. which was tabled in Parliament today, confirms that Najib Abdul Razak and the previous government have, in substance, stolen the RM19.4 billion meant for goods and services tax (GST) refunds.

Specifically, the report confirms three major wrongdoings by Najib and the previous government.

1. Were the GST refunds delayed because of GE14?

First, the PAC investigation confirms that there was an accumulated shortfall of RM19.4 billion for GST refunds because the Finance Ministry did not approve the full amount requested by the Customs Department for GST refunds.

As the PAC report shows, in 2015 and 2016, the additional amount requested by the Customs Department for GST refunds were RM9.969 billion and RM20.764 billion respectively.

Interestingly, the government was able to fulfil the requests during these two periods as RM9.969 billion and RM20.164 billion were approved and transferred into the GST refund fund in 2015 and 2016 respectively.

However, big gaps started appearing in 2017 and 2018. In 2017, the Customs Department requested for RM38 billion for GST refunds, but only RM25.3 billion was approved and transferred. In 2018, the amount requested before the 14th general election (GE14) was RM13.285 billion, but only RM5.8 billion was approved and transferred.

Did Najib and the previous government intentionally delay GST refunds in 2017 and 2018 in order to use the funds for GE14? It is no secret that BN misused government resources to gain political mileage during GE14.

For example, Najib and the previous government paid out RM30 million to DRB-Hicom workers in April 2018 even though Parliament had been dissolved.

Numerous other handout programmes and projects were approved leading up to GE14 in order to induce voters. Inevitably, this would have contributed to the government’s inability to fulfil the GST refunds.

2. Illegally putting moneys collected from GST directly into the consolidated revenue account

Second, the PAC report affirms that, in accordance with Section 54(2) of the GST Act 2014, money collected from GST must be put into a specific GST Refund Account which functions as a trust fund.

Najib and the previous government did not adhere to this as the money collected from GST was instead put directly into the consolidated revenue account.

Najib sought to defend his action by suggesting that he had used his power under Section 54(5) of the GST Act 2014, which empowers the finance minister to authorise the transfer of funds from the GST refund account into the consolidated revenue account.

This is clearly a false justification because money collected from GST must first be transferred to the GST refund fund before being transferred into the consolidated revenue account, not directly into the consolidated revenue account.

In the PAC report, the attorney-general has affirmed that the act of depositing money collected from GST directly into the consolidated revenue account is against the GST Act 2014, and the fundamental principles of trust in law and accounting.

3. Stealing and misusing funds intended for GST refunds

Third, the PAC report confirms that the money for GST refund was used for other government expenses.

Najib and the former secretary general of the Treasury, Irwan Serigar Abdullah, admitted to the PAC that the amount of GST refunds would only be decided after fulfilling the government’s cash flow needs for operating expenditure.

This is a clear admittance that the money for GST refund was stolen because it is, in effect, taking and withholding money from tax payers by force.

Through this, Najib and the previous government were able to enjoy interest-free capital at the expense of taxpayers who had to bear the consequences of not receiving their refunds.

In summary, Najib’s actions were symptomatic of a kleptocrat who had zero regard for the rule of law. The findings of the PAC report show that he has breached the trust of taxpayers by stealing and misusing the money intended for GST refunds.

I strongly agree with the view of the attorney-general that this issue is open for further criminal investigation, and I therefore urge the police and any other relevant authorities to take action immediately.

KHOO POAY TIONG is Kota Melaka MP.

The views expressed here are those of the author/contributor and do not necessarily represent the views of Malaysiakini.

RELATED REPORTS

GST refunds 'robbed': Opposition refers Guan Eng to rights committee

PAC report: GST revenue went to wrong account but 'no money lost'

GST refunds were misused, full stop

Routing GST funds into different account a breach of law, says AG

RM12.50 / month

- Unlimited access to award-winning journalism

- Comment and share your opinions on all our articles

- Gift interesting stories to your friends

- Tax deductable