Federal gov't on track to meet deficit target

MP SPEAKS | The federal government is on track to meet its deficit target of 3.4 percent of the 2019 GDP and will raise RM52 billion worth of net direct debt for development expenditure purposes this year.

The RM52 billion worth of net direct debt for this fiscal year was planned in the 2019 Budget tabled last year. The planned RM52 billion fiscal deficit will translate into 3.4 percent of the 2019 GDP.

The government is on track to meet the 3.4 percent target, which is lower than the 3.7 percent of GDP fiscal deficit or RM53 billion recorded in 2018. The funds raised are entirely allocated for the purposes of development expenditure such as roads and infrastructure for the public.

Allegations that the net direct debt raised to date, or RM58 billion as of Sept 26, 2019, has already exceeded the budgeted RM52 billion for the full year are baseless and false. This is because the RM58 billion figure fails to take into consideration two key factors.

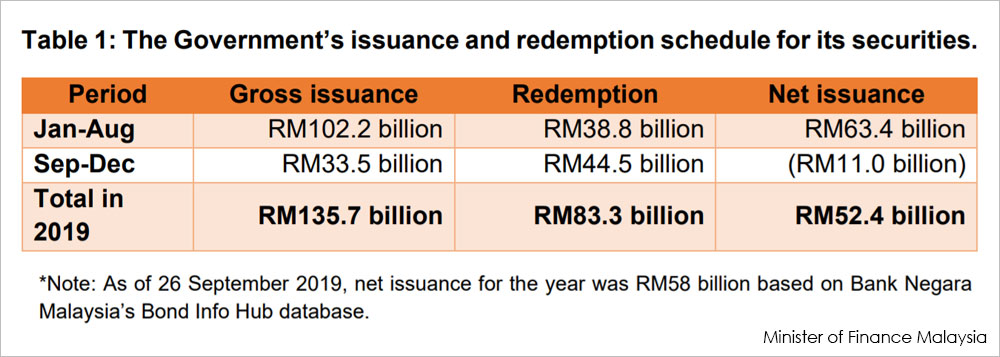

First and most importantly, the government issues and redeems its debt and securities regularly each year based on its yearly debt issuance and redemption schedule. For the whole year, the government plans to raise RM135.7 billion worth of gross direct debt while redeeming RM83.3 billion in return. Specifically, RM38.8 billion has been redeemed in the January-August 2019 period and another RM44.5 billion will be redeemed in the September-December 2019 period.

Hence, looking merely at the current net direct debt figure without taking into consideration the planned redemption of debt and securities for the remainder of the year will give a grossly inaccurate picture of the country’s debt levels. It deliberately distorts the picture by looking at the monthly picture instead of the entire year, as the annual budget is done on a yearly and not monthly basis.

Table 1 below shows the planned issuance and redemption of direct debt by the Government which clearly indicates net direct debt will increase RM52.4 billion only, as budgeted and approved by Parliament in December 2018.

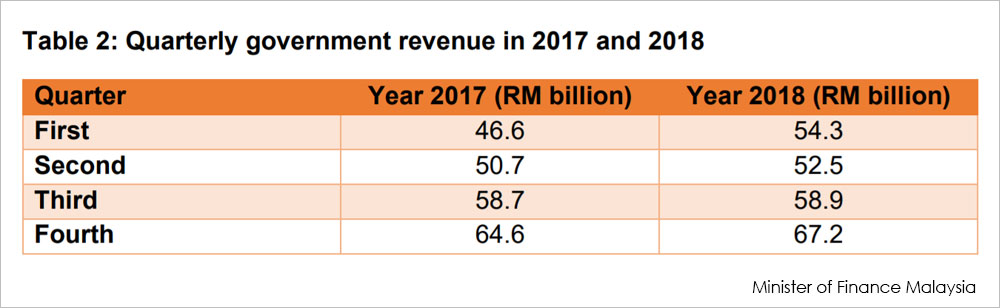

Secondly, issuance and redemption of debt necessarily fluctuates throughout the year in order to regularise the cash flow of the government. The issuance of debt will always be proportionally higher in the first half of the year because the revenue collection for the government is always lower in the same period.

Correspondingly, the redemption of debt will always be higher in the second half of the year because the government will collect higher revenues during this period.

In short, net direct debt figures should be analysed from the yearly perspective, not monthly, accounting for the full-year issuance and redemption plan. Any attempt to jump to conclusions based on mid-year or incomplete data is clearly intended to mislead and does not reflect the true financial position of the government.

This has been the customary financial practice of the government even in the past, and those claiming otherwise despite being part of the previous government are being dishonest.

Bear in mind that revenue collected will be also be used to pay off our existing debt and liabilities, such as 1MDB debt. The Pakatan Harapan government is committed towards fiscal consolidation to rein in the excessive debts chalked up by the previous regime. The government is on track towards meeting its goals and targets set for 2019.

LIM GUAN ENG is finance minister and MP for Bagan.

The views expressed here are those of the author/contributor and do not necessarily represent the views of Malaysiakini.

RM12.50 / month

- Unlimited access to award-winning journalism

- Comment and share your opinions on all our articles

- Gift interesting stories to your friends

- Tax deductable