Maju makes fresh bid for Plus, promises debt write-off and further toll reduction

Maju Holdings Sdn Bhd has sweetened its takeover deal by offering a 36 percent toll reduction in its amended proposal to take over Plus Malaysia Bhd.

In the original proposal, the toll reduction was at 25 percent.

"The company proposes to fully bear the costs of the toll reduction and will not seek compensation from the government," it said in a statement today.

“The government currently owes Plus approximately RM2.7 billion in toll compensation, and if Maju Holdings takes over Plus, we are pleased to inform that we will no longer hold the government responsible for these debts,” it said.

“With this latest offer that we have submitted to the government, existing shareholders of Plus will benefit from an estimated total equity internal rate of return of approximately 16 percent."

“This represents a return that far surpasses the cost of equity for a majority of other toll road concessions, both globally as well as across Southeast Asia.”

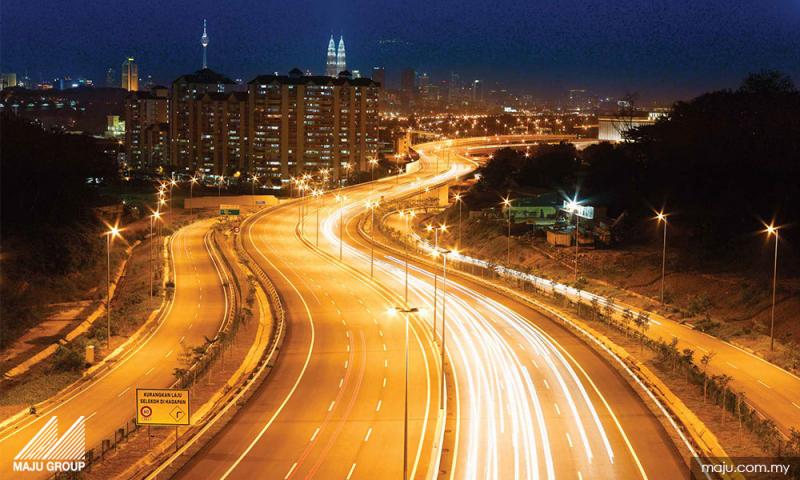

Maju added that it planned to invest about RM5.3 billion in enhancements that would include additional lighting for the highways.

This comes after Plus majority shareholder Khazanah Nasional Bhd said it would not sell its stake.

Khazanah MD Shahril Ridza Ridzuan said the sovereign wealth fund had rejected all takeover offers, saying they were offered prices that were much too low and failed to reflect Plus' real value.

In July, Malaysiakini reported that the takeover bid was causing some friction in Putrajaya with Finance Minister Lim Guan Eng and Works Minister Baru Bian among those with differing viewpoints on the matter.

Maju Holdings is a privately-held company controlled by Abu Sahid Mohamad, who stepped down as the chair of Perwaja Holdings Bhd in 2013.

Its best-known projects are the Bandar Tasik Selatan bus terminal and the Maju Expressway.

Most of its key infrastructure projects were won during the latter half of Dr Mahathir Mohamad's first tenure as prime minister.

RM12.50 / month

- Unlimited access to award-winning journalism

- Comment and share your opinions on all our articles

- Gift interesting stories to your friends

- Tax deductable