IMF sees pandemic causing global recession in 2020, recovery in 2021

The coronavirus pandemic will cause a global recession in 2020 that could be worse than the one triggered by the global financial crisis of 2008-2009, but world economic output should recover in 2021, the International Monetary Fund said on Monday.

IMF managing director Kristalina Georgieva welcomed extraordinary fiscal actions already taken by many countries to boost health systems and protect affected companies and workers, and steps taken by central banks to ease monetary policy. “Even more will be needed, especially on the fiscal front,” she said.

Georgieva issued the new outlook after a conference call of finance ministers and central bankers from the Group of 20 of the world’s largest economies, who she said agreed on the need for solidarity across the globe.

“The human costs of the coronavirus pandemic are already immeasurable and all countries need to work together to protect people and limit the economic damage,” Georgieva said.

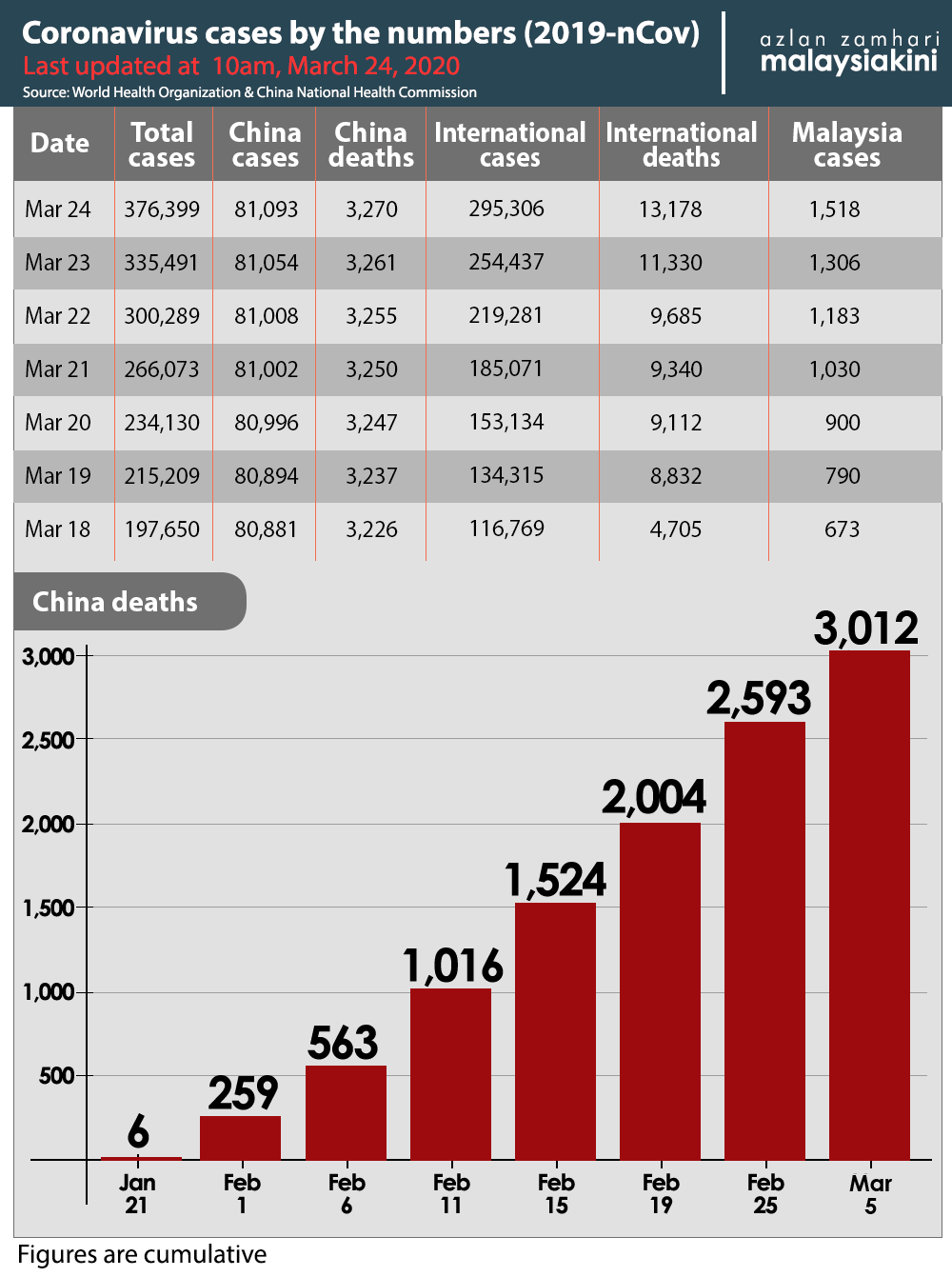

More countries are imposing lockdown measures to contain the rapidly spreading virus, which has infected 337,500 people across the world and killed over 14,600.

Georgieva said the outlook for global growth was negative and the IMF now expected “a recession at least as bad as during the global financial crisis or worse.”

Earlier this month, Georgieva had warned that 2020 world growth would be below the 2.9% rate seen in 2019, but stopped short of predicting a recession. Trade wars pushed global growth last year to the lowest rate since a 0.7% contraction in 2009.

On Monday Georgieva said a recovery was expected in 2021, but to reach it countries would need to prioritise containment and strengthen health systems.

“The economic impact is and will be severe, but the faster the virus stops, the quicker and stronger the recovery will be,” she said.

Emergency finance

Georgieva said the IMF would massively step up emergency finance, noting that 80 countries have already requested help and that the IMF stood ready to deploy all of its US$1 trillion in lending capacity.

Advanced economies were generally in better shape to deal with the crisis, but many emerging markets and low-income countries face significant challenges, including outward capital flows.

Investors have already removed US$83 billion from emerging markets since the start of the crisis, the largest capital outflow ever recorded, Georgieva said.

The IMF is particularly concerned about low-income countries in debt distress and was working closely with them to address those concerns, she added.

The IMF called again on members to contribute funds to replenish its Catastrophe Containment and Relief Trust to help the poorest countries.

Georgieva said the IMF was exploring other options with its members. Several low- and middle-income countries have asked for an allocation for the Special Drawing Right, an international reserve asset created by the IMF in 1969 to supplement its member countries’ official reserves, as was done during the global financial crisis, she said.

IMF members also needed to provide additional swap lines with emerging market countries to address a global liquidity crunch, she said.

The IMF was also exploring a proposal that would help facilitate a broader network of swap lines, including through an IMF-swap-type facility.

- Reuters

RM12.50 / month

- Unlimited access to award-winning journalism

- Comment and share your opinions on all our articles

- Gift interesting stories to your friends

- Tax deductable

Reuters

Reuters