YOURSAY | Losing one’s own home in wake of the pandemic

YOURSAY | ‘Auctioning should be the last resort when all avenues to get the customer to pay are exhausted.’

Woman claims bank unfairly auctioned off home, wants BNM to intervene

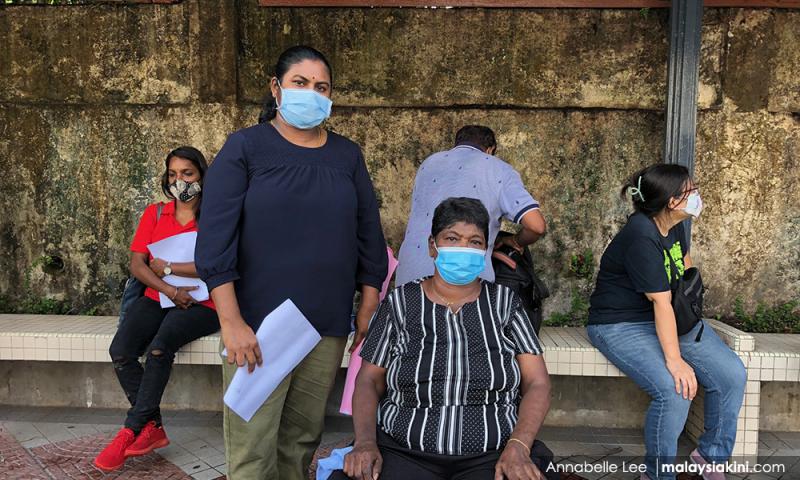

PurpleBird7636: I had a similar experience to tailor M Moganah (photo above, left with her mother, P Letchumy) with a leading commercial bank.

I have been repaying the loan taken for the past 20 years (I would have repaid almost RM350,000 in that period) and had an outstanding balance of around RM6,000 to be settled and around RM8,000 of accumulated late payment interest (LPI) charges due to past defaults.

In early 2020, I wanted to settle in full and wrote to the bank appealing for waivers or discount of the LPI charges and requested the bank to advise me the final settlement amount so that I could make payments.

The bank did not respond to my letter even after seven months, but nevertheless, had initiated foreclosure action without my knowledge through their solicitors. All letters and auction notices were sent to the property address (the property had been vacant for the last 10 years) and I have been moving around to different places due to work requirements.

The bank had my latest address as I have received letters sent to my current address. However, for some reasons, the letters relating to the auction/auction notice were not sent to this address.

Just three days before the day of auction (a Friday), the bank officer in charge of my account called me and told me that my property was to be auctioned the following week on Tuesday and I am to settle the entire outstanding amount without any waivers/discount by Monday - just one day before the auction day if I wish to stop the auction.

I went personally to their Credit Department and collected in person the reply letter from the bank to the letter I sent in early 2020 appealing for LPI waivers and explained to them that I had not made any payments as I was awaiting the bank's letter as to the outcome of my appeal to the LPI waiver and the figure of the full and final settlement figure.

I expressed my unhappiness at the way the officers had handled the matter, the long delay in replying to my letter, the auction action initiated despite writing to them in wanting to settle in full after knowing the full and final settlement amount, and the very short notice given (just three days, including weekends) for me to settle.

I did manage to gather the amount and settle the amount and save my property. As to my subsequent complaints to the bank's customer care, senior management and also Bank Negara, I did not get any response till today although six months had passed.

Yes, there was RM8,000 of LPI charges to be paid. That was the reason I wrote to the bank appealing for waivers/discount and to subsequently advise me the final settlement figure.

Mine was an appeal letter, so whether or not the appeal was approved or not, the bank still has to respond to the borrower and advise him/her of the outcome of the appeal either waived in full/partial, etc, and give instruction on the final settlement sum as requested.

In this case, the bank did not respond till three days before the auction and the auction notice date was three weeks before the date of their response letter. The auction was initiated without the knowledge of the borrower.

Till today, I am still waiting for the response from Bank Negara to the complaint I had lodged with them a long time ago...

Malaysia Bharu: The action of this bank is definitely not reflective of the ethic or moral principle required of a solely service-oriented establishment that depends on the goodwill and patronage of the man on the street for its success.

It comes across as a cold and calculated machinery bereft of compassion and conscience poaching on the weak and gullible to feed its avarice.

There are a number of issues here. If the repayment was increased from RM268 to RM325 in July 2018 due to increased interest, why did the bank continue to accept repayments at the previous rate of RM268 till October 2020 when it went for foreclosure?

Isn't it obvious that the house owner was unaware of the increase notwithstanding the fact that she was repaying by auto-debit? And how did the bank go for foreclosure and auction without communicating with the owner who has been servicing her loan for 17 years and had only four more years to go?

Although the bank disputes Moganah's claim that she did update her address in 2005, why didn't the bank make an effort to trace her at least before foreclosing and auctioning her property? After all, Moganah and her family were residing in the same mortgaged house.

Based on the facts, if this is the SOP of this bank, it comes across as a fraudulent action intended for profiteering considering the property's original market value and the current value at the time of auction.

Bank Negara, as the supervising authority, must be held responsible as this could be the tip of the iceberg considering the number of banks in operation. There must be an investigation into others that have been cheated under similar circumstance considering this matter would not have been exposed if not for Moganah's outcry.

Billythekid: The poor are working day and night to make ends meet and service these loans. Many are quite illiterate and could easily be ill-advised by neighbours.

The clearly damning point in the bank's processing is that no officer made it a point to personally contact by visiting the victim to explain the situation. Blaming the victim for not updating her address and telephone number (which was allegedly done years earlier) is the lamest excuse because the customer being a B40 citizen.

It’s time for Bank Negara to review regulations of action by the bank before an auction, one of which should be that the person who may have defaulted should be personally informed when letters are not responded to.

Another point that should be noticed is the customer has been diligently paying the instalment even though it was the old rate. Surely, that must alert any decent bank officer that something is amiss. The cruelty under any circumstances must not go unnoticed by the authorities.

Jackal Way: If the bank is willing to accept the payment albeit it's not the full amount, the bank has no rights to auction the house. On top of that, three months without full payment doesn't warrant the bank to take such drastic action. Maybe more details on what exactly happened are needed.

Mazilamani: I thought Shylock (a fictional character in ‘The Merchant of Venice’) died with Shakespeare, but it had mutated to other forms, namely banks.

Just because Moganah continued paying the original monthly loan repayment, without being aware of an increased instalment repayment, what gave the bank the right to auction the house?

Can Moganah sue the bank for failure to notify through regular means, including through courier services? She and her family have been subjected to mental agony and humiliation. Bank Negara must come down hard on this bank. The victims, sadly, are from the lower-income group.

Dr Raman Letchumanan: Malaysiakini, thanks for carrying this story. Parti Sosialis Malaysia, I salute you. I am sure there are many similar cases.

I am glad the victim is not settling for compensation. She is a brave principled lady. The bank ought to be named. I hope Bank Negara will also not cover up but impose a huge fine or withdraw their licence. Banks willfully do that because they know they can settle for a pittance.

All this is happening during the Covid-19 pandemic. Banks are supposed to provide moratorium for loans, not auction off property. Perikatan Nasional (PN) and Finance Ministry, what say you? Don't just keep quiet.

The above is a selection of comments posted by Malaysiakini subscribers. Only paying subscribers can post comments. In the past year, Malaysiakinians have posted over 100,000 comments. Join the Malaysiakini community and help set the news agenda. Subscribe now.

These comments are compiled to reflect the views of Malaysiakini subscribers on matters of public interest. Malaysiakini does not intend to represent these views as fact.

RM12.50 / month

- Unlimited access to award-winning journalism

- Comment and share your opinions on all our articles

- Gift interesting stories to your friends

- Tax deductable