Banks offering loan moratorium only for those who lost jobs

Banks will only offer a three-month loan repayment moratorium for borrowers who lose their jobs, according to the Association of Banks in Malaysia (ABM).

Alternatively, unemployed borrowers can also opt for a 50 percent reduction in monthly instalment payments for a period of six months.

Another scheme is on offer for those experiencing reduced income, including household income. They will be eligible for a commensurate reduction in monthly instalment payments.

Borrowers in the B40 category - defined as those eligible for Bantuan Sara Hidup (BSH) or Bantuan Prihatin Rakyat (BPR) welfare payments - are eligible for the commensurate reduction in monthly instalment payments, if they don't qualify for the first scheme.

Small businesses with a loan of not more than RM150,000 may also opt for the second scheme.

ABM explained that these measures form the expansion of the Targeted Repayment Assistance (TRA), in place since Oct 1, 2020.

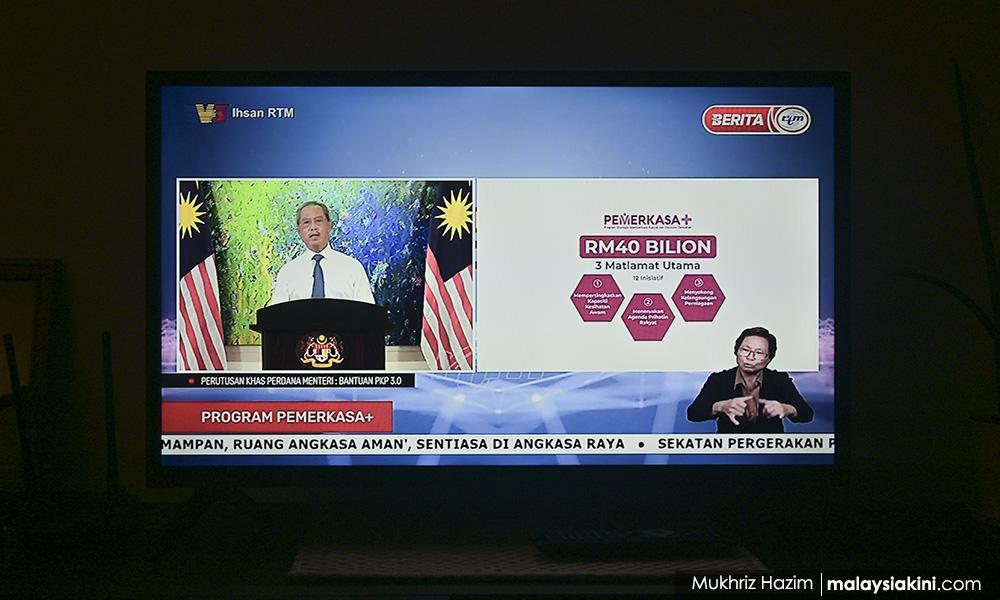

The clarification by ABM today contained some differences compared to what was announced by Prime Minister Muhyiddin Yassin in his “Pemerkasa Plus” speech last night.

Most media organisations had reported that those in the B40 category are eligible for either a three-month loan repayment moratorium or the 50 percent reduction in loan payment moratorium for six months.

Since the start of the third movement control order in January, government critics have been repeatedly calling for Putrajaya to implement a blanket loan moratorium scheme to prevent businesses from folding and individuals from becoming bankrupt.

Malaysians have been banned from non-essential travel involving different districts since January.

Critics have also pointed out that unlike most sectors, the Covid-19 pandemic had minimal effects on banks.

During the first quarter of this year, Malaysia’s top five banks - CIMB (RM2.46 billion), Maybank (RM2.38 billion), Public Bank (RM1.53 billion), Hong Leong (RM771.47 million) and RHB (RM650.39 million) - all posted healthy profits.

RM12.50 / month

- Unlimited access to award-winning journalism

- Comment and share your opinions on all our articles

- Gift interesting stories to your friends

- Tax deductable