PNB to add infrastructure assets in diversification drive

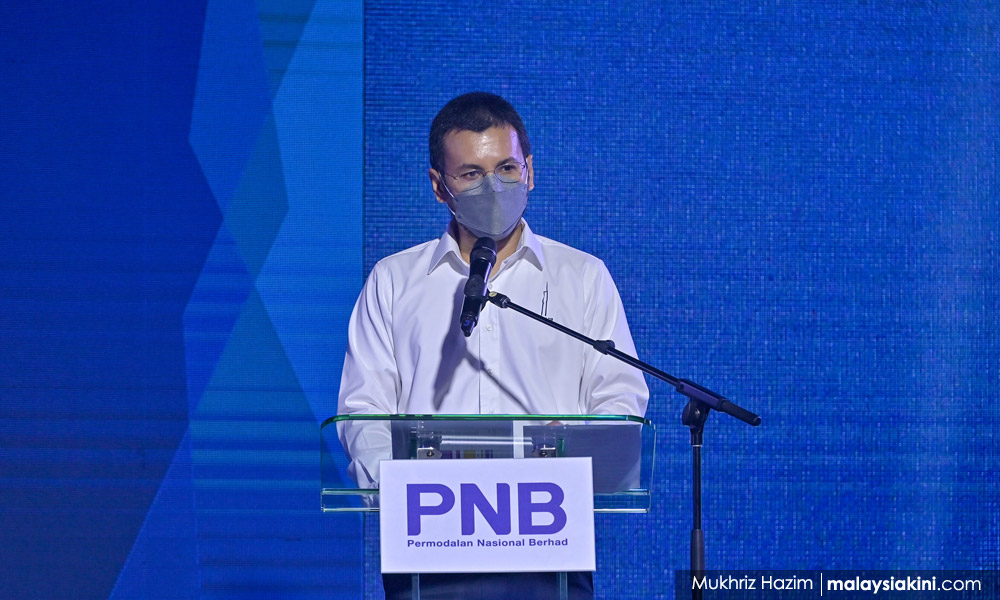

The country's largest asset manager, Permodalan Nasional Bhd (PNB), plans to add infrastructure assets into its portfolio from next year to diversify its exposure and navigate the current high inflationary environment, its top executive said.

PNB, which managed RM336.7 billion of assets in 2021, has the majority of its portfolio invested in public equities, both local and international, besides private investments and real estate, among others.

"It's great as an asset class as it further diversifies our portfolio and improves the risk-return characteristics of the portfolio," PNB's Group CEO Ahmad Zulqarnain Onn told Reuters in an interview during a visit to Singapore.

"People are starting to look at how to protect their portfolios against the deterioration of value coming from inflation," Zulqarnain said, adding that globally, funds were under-allocated to infrastructure as an asset class.

The move by the state-owned investment manager comes at a time when global private equity firms and asset managers are moving in on billions of dollars of infrastructure assets across Southeast Asia, lured by the sector's growth prospects and stable, long-term returns.

Zulqarnain, a former deputy managing director at sovereign wealth fund Khazanah Nasional Bhd, said PNB has set up a small team for its infrastructure strategy and will scale this up once it begins to make investments.

"We'll be investing into portfolios of infrastructure assets and infra managers with a track record that will give PNB exposure to a very diversified portfolio," Zulqarnain, 49, said in an interview on the sidelines of the Milken Institute Asia Summit in Singapore.

"The asset class itself has matured so that you can play it just like real estate. You can choose risk levels as well," he said. "There's a lot of activity in telecoms, data centres, ports, roads, so really across the gamut."

Zulqarnain, a Harvard graduate, said there was a huge demand for infrastructure in emerging markets including Southeast Asia, given upgrades to airports and roads, especially in countries such as Indonesia.

PNB, which was set up in 1978, has stakes in some of the biggest companies such as lender Maybank and Sime Darby Plantation but has been diversifying its portfolio, across geographies and asset classes.

Since it first started investing globally six years ago, the share of international investments in its total portfolio has risen to 17 percent as of end-2021, PNB's annual report shows.

Zulqarnain said though global markets have dropped sharply this year on investor worries over economic growth following big increases in interest rates by inflation-fighting central banks, he saw opportunities to pick up bargains.

"Now that interest rates and yield curves have shifted up, I think, we will start adding to fixed income," he said.

"And even in public equity, we see valuations coming down to much more attractive levels," Zulqarnain said. "Stay the course, pace ourselves appropriately, and have that long-term view and then that pays off," he said.

- Reuters

RM12.50 / month

- Unlimited access to award-winning journalism

- Comment and share your opinions on all our articles

- Gift interesting stories to your friends

- Tax deductable

Reuters

Reuters