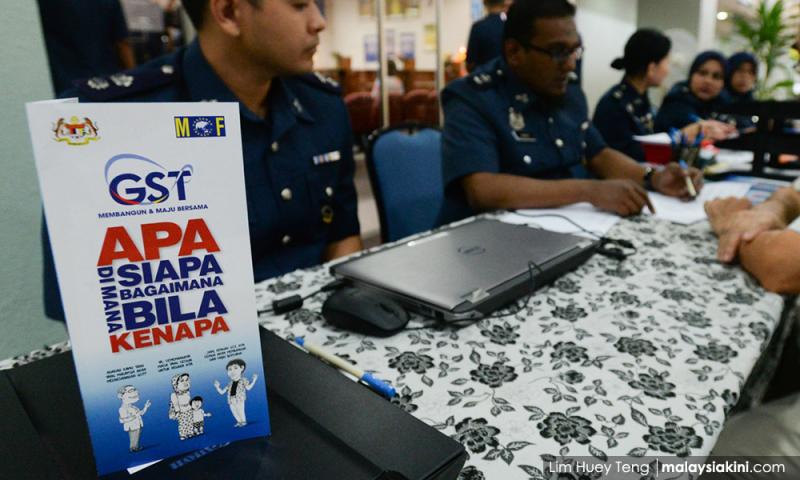

YOURSAY | Poor will be affected by GST implementation

YOURSAY | ‘Many wage earners are struggling to survive.’

COMMENT | Anwar doesn't understand GST, or his hands are tied

Commenting has been disabled for this story: I am afraid it is you, Malaysiakini columnist P Gunasegaram, who is mistaken.

The notion that the poor are less affected by introducing goods and services tax (GST) because they consume less is a fallacy.

Allow me to explain.

1. Consumption taxes like GST are regressive, meaning, they take a larger percentage from a lower-income person than a higher-income person.

Yes, a poor man might pay less GST, but the amount he pays means a lot to him. The rich man pays more GST, but the amount doesn't mean that much to him.

RM100 means more to a poor man than RM1000 to a rich man.

2. The poorer you are, the less flexibility you have to absorb the taxes because your liquidity is low.

So even if you pay fewer taxes, your ability to recover from the financial hit is lower, whereas a rich man who pays higher taxes can still recover easily because he has liquidity.

It takes money to make money.

3. Unlike income tax, which is based on a person's ability to pay, consumption tax is a flat rate. So, it doesn't take into account financial ability.

4. The idea that the poor consume less isn't true all the time. The poor tend to have more children.

They buy cheaper goods that require more frequent replacement or maintenance. So, while they may buy cheaper things, they tend to buy more of them, and that adds up.

In conclusion, consumption taxes tend to affect the poor more heavily in relative terms because they spend a larger share of their income on taxed goods and have less ability to save or invest untaxed income.

GanMu: I disagree. This is a well-written article. His unwavering stance on the advantages of introducing a GST, which will result in a phenomenal increase in the government's coffers, goes to show that GST is the way forward.

When your story is headlined "Anwar doesn't understand GST, or his hands are tied" - I tend to agree with you on the former.

Whilst he may not fully understand GST, it is difficult to comprehend why he does not have the political will to "bite the bullet" and take a proactive approach to doing what more than 100 countries are doing and the benefits they are getting.

As a responsible leader, the prime minister should take a pragmatic approach to reintroducing GST, just like what former prime minister Najib Abdul Razak did.

Once Anwar says okay, then gets his boys moving fast to plug in on all the questions, and problems and get the job done.

If he says no, everyone else will say "yes sir". He should stop looking at GST negatively. Instead, see it as a means for the country to move forward.

It is the prime minister who should make this move. I hope he shows more interest in moving the country upward economically with the same vigour he is doing with religion.

Anwar should stop saying that it will affect the poor.

As Guna rightfully pointed out, "GST was introduced in 2015 it had over 200 items which had zero taxes to minimise the impact on the poor, including food items, cheaper clothing, medical expenses, insurance etc."

Even without GST, the cost of most items is much higher. The prime minister is not well-versed in all aspects of GST. Perhaps he should talk to Guna.

Apanama is back: The issue here is the incompetence of the prime minister and his advisers.

I do not know what Treasury secretary-general Johan Mahmood Merican and his people are doing.

So far, it looks like they are sleeping on this GST matter. Since the first introduction of a Value-Added Tax in France in 1954, it has been adopted by 175 countries around the world.

GST has nothing to do with people with low incomes.

Even if the minimum wage in Malaysia is RM3,000, Anwar will probably say that GST would be introduced only if the minimum income rises between RM5,000 and RM6,000 per month.

He takes the populist approach in almost all economic matters.

Look at how he refuses to take a monthly salary. It is merely a populist move, and it won't work in the long run.

Of course, this populist move is popular among his supporters who fear the green wave.

The administration wants an easy way to manage it rather than be creative.

By implementing various GST tax brackets on different products and services while exempting the poor from GST.

This ensures our national coffers still enjoy higher annual revenue collection. This, in turn, will help the poor.

Kunta kinte: Any economist can tell you GST is a regressive tax.

It doesn't fall on the premise that if you are poor you spend less and therefore tax less.

It is the proportion of income that was spent that counts. The poor tend to spend most of their income while the rich proportionally spend less of their income.

Salvage Malaysia: There is a reason why GST is called a consumption tax.

Implement GST, abolish all the other unnecessary taxes like capital gains tax (CGT), reduce the corporate and personal income tax by one percent first, zero rate taxes on essential goods and start with a lower four percent GST.

Overall, the government will still be better off than it is now.

MarioT: Many wage earners are struggling to survive. The cost of living is going up but wages are not proportionate to the rise.

GST can pose an additional burden on the low and medium-income workforce as the prices of goods would rise.

Thus, implementation of the GST at this time is not a good idea.

The above is a selection of comments posted by Malaysiakini subscribers. Only paying subscribers can post comments. In the past year, Malaysiakinians have posted over 100,000 comments. Join the Malaysiakini community and help set the news agenda. Subscribe now.

These comments are compiled to reflect the views of Malaysiakini subscribers on matters of public interest. Malaysiakini does not intend to represent these views as fact.

RM12.50 / month

- Unlimited access to award-winning journalism

- Comment and share your opinions on all our articles

- Gift interesting stories to your friends

- Tax deductable